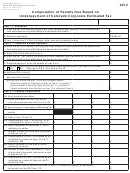

Part 4 Annualized Installment

Method Schedule

23. Ending date of annualization period ..............

24. Colorado taxable income computed

$

$

$

$

$

$

$

$

$

$

$

$

through the date on line 23 ............................

12

6

4

3

2.4

2

1.72

1.5

1.33

1.2

1.09

1

25. Annualization Factor ......................................

26. Annualized taxable income. Line 24

$

$

$

$

$

$

$

$

$

$

$

$

times line 25 ..................................................

$

$

$

$

$

$

$

$

$

$

$

$

27. Line 26 times 4.63% .......................................

5.833% 11.667%

17.5%

23.333% 29.167%

35%

40.833% 46.667%

52.5%

58.333% 64.167%

70%

28. Applicable percentage ...................................

29. Installment payment due. Line 27 times line

28, minus amounts entered on line 29 in

$

$

$

$

$

$

$

$

$

$

$

$

earlier quarters. Enter here and on line 11 ...

Instructions for DR 206

Part 1 Generally you are subject to an estimated tax penalty if your current tax

based on the actual tax liability for the current tax year and any underpayment

occurring in the first month as a result of this estimation must be repaid with

year's estimated tax payments are not paid in a timely manner. The estimated

tax penalty will not be assessed if the Colorado tax liability is less than

the second monthly payment.

$5,000.

Part 3 Compute the penalty on lines 10 through 22 of Form 206. Complete

Part 2 The required annual amount to be paid is the lesser of:

each column before going to the next column. The dates to be entered on line

10 are the 15th day of the each month of the taxable year. Corporations filing for

1. 70% of actual Colorado tax liability, or

a short tax year must adjust lines 9, 10 and 11 accordingly. Large corporations

2. 100% of preceding year's Colorado tax liability:

must complete line 11 based on the computations from line 9 or 29.

only applies if

Part 4 Taxpayers who do not receive income evenly during the year may elect

• The preceding year was 12-month tax year, and

to use the annualized income installment method to compute their estimated

• The corporation filed a Colorado return, and

tax payments. Complete the annualized installment method schedule to

• The corporation is not defined under section 6655 of the federal IRS

compute the amounts to enter on line 11.

code as a large corporation*

For additional information regarding the estimated tax penalty see FYI Income

*Large corporations can base their first monthly estimated tax payment on

51, which is available at

8.33% of the previous year's tax liability. However, future payments must be

1

1 2

2