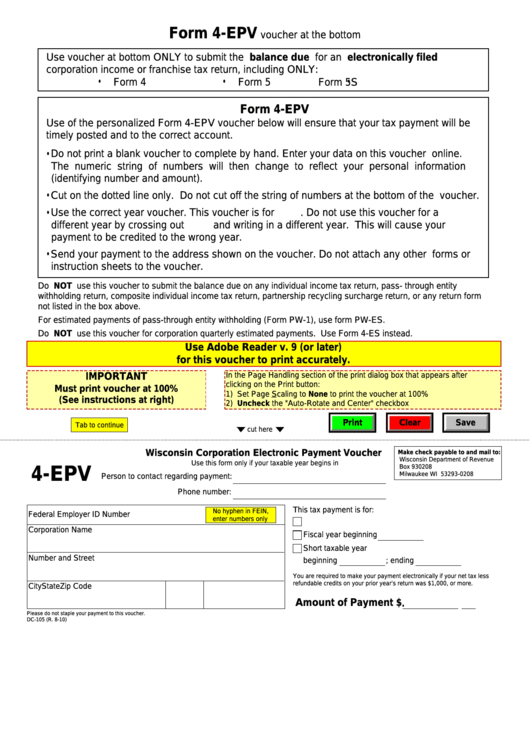

Form 4-EPV

voucher at the bottom

Use voucher at bottom ONLY to submit the balance due for an electronically filed

corporation income or franchise tax return, including ONLY:

•

•

•

Form 4

Form 5

Form 5S

Form 4-EPV

Use of the personalized Form 4-EPV voucher below will ensure that your tax payment will be

timely posted and to the correct account.

• Do not print a blank voucher to complete by hand. Enter your data on this voucher online.

The numeric string of numbers will then change to reflect your personal information

(identifying number and amount).

•Cut on the dotted line only. Do not cut off the string of numbers at the bottom of the voucher.

• Use the correct year voucher. This voucher is for

. Do not use this voucher for a

different year by crossing out

and writing in a different year. This will cause your

payment to be credited to the wrong year.

•Send your payment to the address shown on the voucher. Do not attach any other forms or

instruction sheets to the voucher.

Do NOT use this voucher to submit the balance due on any individual income tax return, pass- through entity

withholding return, composite individual income tax return, partnership recycling surcharge return, or any return form

not listed in the box above.

For estimated payments of pass-through entity withholding (Form PW-1), use form PW-ES.

Do NOT use this voucher for corporation quarterly estimated payments. Use Form 4-ES instead.

Use Adobe Reader v. 9 (or later)

for this voucher to print accurately.

IMPORTANT

In the Page Handling section of the print dialog box that appears after

clicking on the Print button:

Must print voucher at 100%

1) Set Page Scaling to None to print the voucher at 100%

(See instructions at right)

2) Uncheck the "Auto-Rotate and Center" checkbox

Print

Clear

Save

Tab to continue

cut here

Wisconsin Corporation Electronic Payment Voucher

Make check payable to and mail to:

Wisconsin Department of Revenue

Use this form only if your taxable year begins in

Box 930208

4-EPV

Milwaukee WI 53293-0208

Person to contact regarding payment:

Phone number:

This tax payment is for:

No hyphen in FEIN,

Federal Employer ID Number

enter numbers only

Corporation Name

Fiscal year beginning

Short taxable year

Number and Street

beginning

; ending

You are required to make your payment electronically if your net tax less

refundable credits on your prior year’s return was $1,000, or more.

City

State

Zip Code

Amount of Payment $

.

Please do not staple your payment to this voucher.

DC-105 (R. 8-10)

1

1