Form E-1 - Vermont Estate Tax Return Page 2

ADVERTISEMENT

Who Must File a VT Estate Tax Return?

The executor or other fiduciary is required to file a Vermont return for all estates with a tax due under 32 V.S.A. §7442a.

Nonresident estates that include personal property, real estate, or other income producing property located in Vermont are

required to file using the total value of Vermont and out-of-state assets in determining Vermont Estate tax liability.

•

For decedents who died after December 31, 2008 and before January 1, 2011, a tax is due if the sum of the tentative

taxable estate and adjusted taxable gifts as reported on Federal Form 706 is greater than $2,000,000.

•

For decedents who died after December 31, 2010, a tax is due if the sum of the tentative taxable estate and adjusted

taxable gifts as reported on Federal Form 706 is greater than $2,750,000.

GENERAL INSTRUCTIONS

Date of Filing Returns

Vermont Estate Tax Returns are required to be filed within nine months of the death of the decedent. Prior to expiration of

the filing period, executors may apply for a six-month extension. For estates filing a federal return, the expiration of the

federal filing period is extended for deaths occurring in 2010. However, this additional federal extension does not extend

the time for filing the Vermont Estate Tax Return.

Tax Payable

The Vermont Estate Tax is due and payable by the executor or other fiduciary at the time the Vermont Estate Tax Return is

required to be filed. An extension of time to file the VT Estate Tax Return does not extend the time to pay. The tax estimated

to be due must be paid with the extension of time request.

Where to File

Vermont Department of Taxes

133 State Street

Montpelier, VT 05633-1401

What to File When a Vermont Return is Required

•

In the case where no federal tax or return is due, the executor must file a complete pro forma Federal Form 706,

including all exhibits and appraisals, with the Vermont Estate Tax Return.

•

When Federal tax is due and all assets are located in Vermont, the first page of Federal Form 706 should be included

with the Vermont return.

•

When Federal tax is due, and some assets are located outside of Vermont, attach the Federal Form 706 to the Vermont

return excluding exhibits and appraisals.

•

A duplicate of the estate tax closing letter issued by the IRS must be filed with this Department.

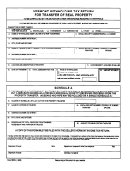

Special Instructions for Schedule A

The value to use for Schedule A, Line 5 is determined from a calculation of the tax on a pro forma Federal Form 706. To

complete the calculation on the Federal pro forma, no state death tax deduction is allowed (Federal Form 706, Line 3b) and

the maximum unified credit (Federal Form 706, Line 9) is $780,800 for deaths occurring in 2006-2010 and $943,300 for

deaths occurring after December 31, 2010. (Line numbers are provided from the 9-2009 version of the Federal Form 706.

If more recent versions of the federal form are used, check for the appropriate line numbers.)

VT ESTATE TAX DEFINITIONS

Vermont Resident Decedent means a person whose domicile is in Vermont at date of death.

* Non-Vermont Gross Estate for a Vermont Resident Decedent means the total value of real estate and tangible personal

property (cars, boats, clothes, jewelry, furniture, etc.) which is located outside Vermont at the date of death and is

taxed by another state.

** Vermont Gross Estate for a nonresident decedent means the value of real estate and tangible personal property (cars,

boats, clothes, jewelry, furniture, etc.) located in Vermont at date of death.

PLEASE NOTE: Bank accounts, stocks, bonds and mortgages are intangible assets and are taxable by the State in which

the decedent was a resident at time of death regardless of where the asset was located at the date of death.

NOTE: An estate with a closely-held farm business may be eligible

for a special reduction in the Vermont estate tax. Contact the Vermont

Department of Taxes at (802) 828-6820 for more information.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4