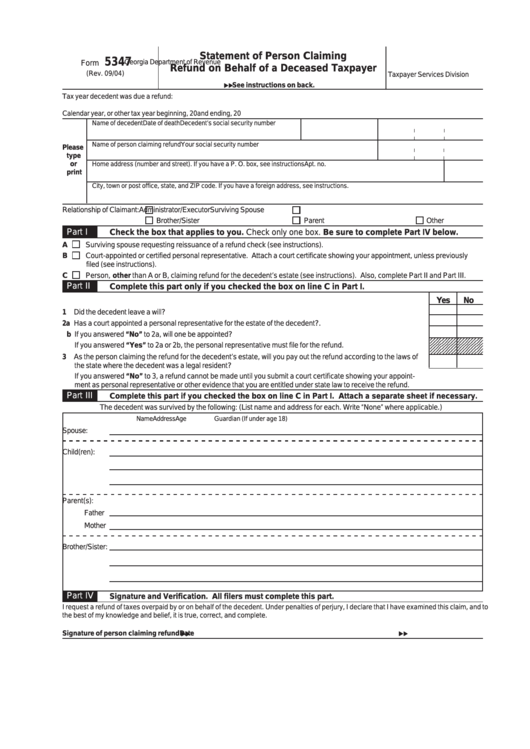

Form 5347 - Statement Of Person Claiming Refund On Behalf Of A Deceased Taxpayer

ADVERTISEMENT

Statement of Person Claiming

5347

Georgia Department of Revenue

Form

Refund on Behalf of a Deceased Taxpayer

(Rev. 09/04)

Taxpayer Services Division

See instructions on back.

Tax year decedent was due a refund:

Calendar year

, or other tax year beginning

, 20

and ending

, 20

Name of decedent

Date of death

Decedent’s social security number

Name of person claiming refund

Your social security number

Please

type

or

Home address (number and street). If you have a P. O. box, see instructions

Apt. no.

print

City, town or post office, state, and ZIP code. If you have a foreign address, see instructions.

Relationship of Claimant:

Administrator/Executor

Surviving Spouse

Brother/Sister

Parent

Other

Part I

Check the box that applies to you. Check only one box. Be sure to complete Part IV below.

A

Surviving spouse requesting reissuance of a refund check (see instructions).

B

Court-appointed or certified personal representative. Attach a court certificate showing your appointment, unless previously

filed (see instructions).

C

Person, other than A or B, claiming refund for the decedent’s estate (see instructions). Also, complete Part II and Part III.

Part II

Complete this part only if you checked the box on line C in Part I.

Yes

No

1 Did the decedent leave a will? .............................................................................................................................

2a Has a court appointed a personal representative for the estate of the decedent? .................................................

b If you answered “No” to 2a, will one be appointed? ............................................................................................

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

If you answered “Yes” to 2a or 2b, the personal representative must file for the refund.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

3 As the person claiming the refund for the decedent’s estate, will you pay out the refund according to the laws of

the state where the decedent was a legal resident? ............................................................................................

If you answered “No” to 3, a refund cannot be made until you submit a court certificate showing your appoint-

ment as personal representative or other evidence that you are entitled under state law to receive the refund.

Part III

Complete this part if you checked the box on line C in Part I. Attach a separate sheet if necessary.

The decedent was survived by the following: (List name and address for each. Write “None” where applicable.)

Name

Address

Age

Guardian (If under age 18)

Spouse:

Child(ren):

Parent(s):

Father

Mother

Brother/Sister:

Part IV

Signature and Verification. All filers must complete this part.

I request a refund of taxes overpaid by or on behalf of the decedent. Under penalties of perjury, I declare that I have examined this claim, and to

the best of my knowledge and belief, it is true, correct, and complete.

Signature of person claiming refund

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2