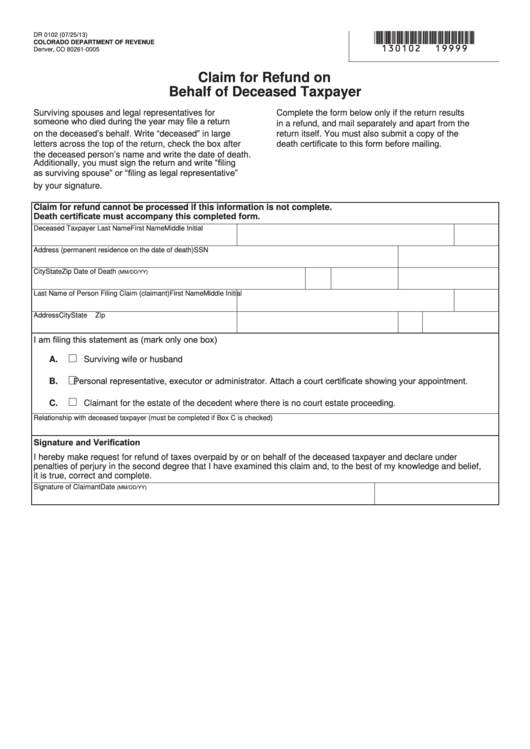

*130102==19999*

DR 0102 (07/25/13)

COLORADO DEPARTMENT OF REVENUE

Denver, CO 80261-0005

Claim for Refund on

Behalf of Deceased Taxpayer

Surviving spouses and legal representatives for

Complete the form below only if the return results

someone who died during the year may file a return

in a refund, and mail separately and apart from the

on the deceased’s behalf. Write “deceased” in large

return itself. You must also submit a copy of the

death certificate to this form before mailing.

letters across the top of the return, check the box after

the deceased person’s name and write the date of death.

Additionally, you must sign the return and write “filing

as surviving spouse” or “filing as legal representative”

by your signature.

Claim for refund cannot be processed if this information is not complete.

Death certificate must accompany this completed form.

Deceased Taxpayer Last Name

First Name

Middle Initial

Address (permanent residence on the date of death)

SSN

City

State

Zip

Date of Death

(MM/DD/YY)

Last Name of Person Filing Claim (claimant)

First Name

Middle Initial

Address

City

State

Zip

I am filing this statement as (mark only one box)

A.

Surviving wife or husband

Personal representative, executor or administrator. Attach a court certificate showing your appointment.

B.

C.

Claimant for the estate of the decedent where there is no court estate proceeding.

Relationship with deceased taxpayer (must be completed if Box C is checked)

Signature and Verification

I hereby make request for refund of taxes overpaid by or on behalf of the deceased taxpayer and declare under

penalties of perjury in the second degree that I have examined this claim and, to the best of my knowledge and belief,

it is true, correct and complete.

Signature of Claimant

Date

(MM/DD/YY)

1

1