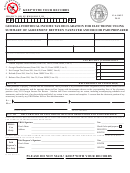

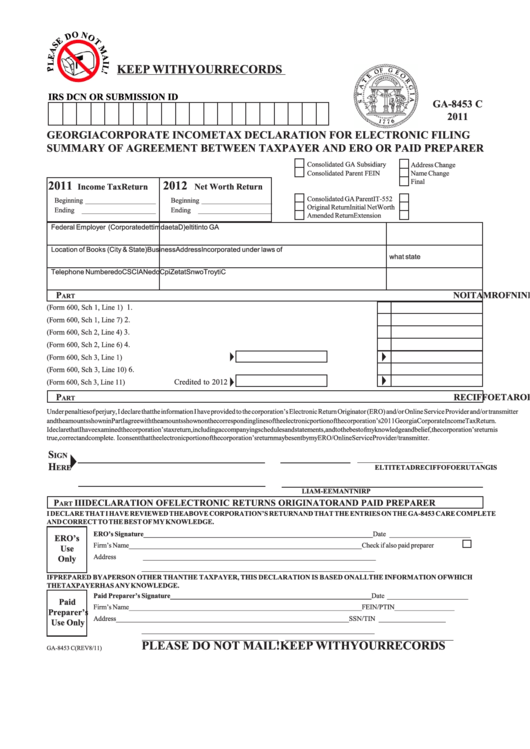

Form Ga-8453c - Corporate Income Tax Declaration For Electronic Filing Summary Of Agreement Between Taxpayer And Ero Or Paid Preparer - 2011

ADVERTISEMENT

KEEP WITH YOUR RECORDS

IRS DCN OR SUBMISSION ID

GA-8453 C

2011

GEORGIA CORPORATE INCOME TAX DECLARATION FOR ELECTRONIC FILING

SUMMARY OF AGREEMENT BETWEEN TAXPAYER AND ERO OR PAID PREPARER

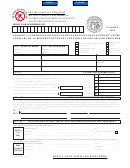

Consolidated GA Subsidiary

Address Change

Consolidated Parent FEIN

Name Change

2011

2012

Final

Income Tax Return

Net Worth Return

Consolidated GA Parent

IT-552

Beginning ____________________

Beginning ____________________

Original Return

Initial Net Worth

Ending

_____________________

Ending

_____________________

Amended Return

Extension

Federal Employer I.D. Number

Name (Corporate

l t i t

) e

D

a

e t

a

d

m

t i

e t

d

into GA

Location of Books (City & State)

Business Address

Incorporated under laws of

what state

Telephone Number

C

y t i

r o

T

o

w

n

S

a t

e t

Z

p i

C

o

d

e

N

A

C I

S

C

o

d

e

P

I

T

A

X

R

E

T

U

R

N

I

N

F

O

R

M

A

T

I

O

N

ART

1. Federal taxable income

1.

(Form 600, Sch 1, Line 1) ......................................................................................

2. Georgia taxable income

2.

(Form 600, Sch 1, Line 7) .....................................................................................

3. Net Worth

(Form 600, Sch 2, Line 4) ............................................................................................................

3.

4. Net Worth Taxable by Georgia

4.

(Form 600, Sch 2, Line 6) ..........................................................................

5. Tax Amounts

Income

..... Net Worth

(Form 600, Sch 3, Line 1) ............

6. Balance of Tax due with return

6.

(Form 600, Sch 3, Line 10)........................................................................

7. Refund

Credited to 2012

...... Refunded

(Form 600, Sch 3, Line 11) ....

P

I I

D

E

C

L

A

R

A

T

I

O

N

O

F

C

O

R

P

O

R

A

T

E

O

F

I F

C

E

R

ART

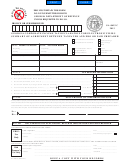

Under penaltiesof perjury, I declare that the informationI have provided to the corporation’s ElectronicReturn Originator(ERO) and/or Online Service Provider and/or transmitter

and the amounts shown in Part I agree with the amounts shown on the correspondinglines of the electronic portionof the corporation’s 2011 Georgia CorporateIncomeTax Return.

I declarethat I have examinedthe corporation’s tax return,includingaccompanyingschedulesand statements, and to the best of my knowledge and belief, the corporation’s return is

true, correct and complete. I consent that the electronic portion of the corporation’s return may be sent by my ERO/Online Service Provider/transmitter.

S

IGN

H

ERE

I S

G

N

A

T

U

R

E

O

F

O

F

I F

C

E

R

D

A

T

E

T

I

T

L

E

P

R

I

N

T

N

A

M

E

- E

M

A

I

L

P

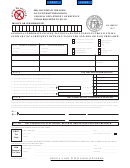

III

DECLARATION OF ELECTRONIC RETURNS ORIGINATOR AND PAID PREPARER

ART

I DECLARE THAT I HAVE REVIEWED THEABOVE CORPORATION’S RETURNAND THAT THE ENTRIES ON THE GA-8453 CARE COMPLETE

AND CORRECTTO THE BEST OF MYKNOWLEDGE.

ERO’s Signature _________________________________________________________________

Date _______________________

ERO’s

Firm’s Name

__________________________________________________________________

Check if also paid preparer

Use

Address

__________________________________________________________________

Only

__________________________________________________________________

IF PREPARED BYA PERSON OTHER THAN THE TAXPAYER, THIS DECLARATION IS BASED ON ALL THE INFORMATION OF WHICH

THE TAXPAYER HAS ANY KNOWLEDGE.

Paid Preparer’s Signature _________________________________________________________

Date _______________________

Paid

Firm’s Name

__________________________________________________________________

FEIN/PTIN _________________

Preparer’s

Address

__________________________________________________________________

SSN/TIN ___________________

Use Only

__________________________________________________________________

PLEASE DO NOT MAIL! KEEP WITH YOUR RECORDS

GA-8453 C (REV 8/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2