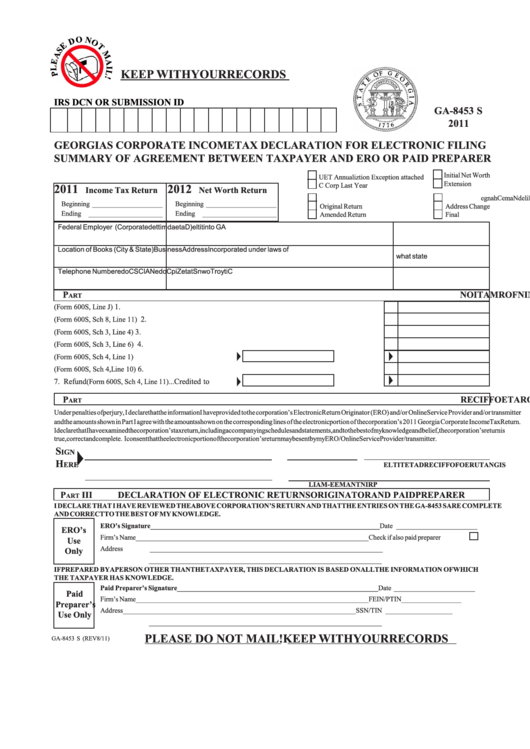

Form Ga-8453 S - Georgia S Corporate Income Tax Declaration For Electronic Filing Summary Of Agreement Between Taxpayer And Ero Or Paid Preparer - 2011

ADVERTISEMENT

KEEP WITH YOUR RECORDS

IRS DCN OR SUBMISSION ID

GA-8453 S

2011

GEORGIA S CORPORATE INCOME TAX DECLARATION FOR ELECTRONIC FILING

SUMMARY OF AGREEMENT BETWEEN TAXPAYER AND ERO OR PAID PREPARER

Initial Net Worth

UET Annualiztion Exception attached

Extension

2011

2012

C Corp Last Year

Income Tax Return

Net Worth Return

C

o

m

p

s o

e t i

R

e

u t

n r

F

l i

d e

N

a

m

e

C

h

n a

e g

Beginning ____________________

Beginning ____________________

Original Return

Address Change

Ending

_____________________

Ending

_____________________

Amended Return

Final

Federal Employer I.D. Number

Name (Corporate

l t i t

) e

D

a

e t

a

d

m

t i

e t

d

into GA

Location of Books (City & State)

Business Address

Incorporated under laws of

what state

Telephone Number

C

y t i

r o

T

o

w

n

S

a t

e t

Z

p i

C

o

d

e

N

A

C I

S

C

o

d

e

P

I

T

A

X

R

E

T

U

R

N

I

N

F

O

R

M

A

T

I

O

N

ART

1. Federal ordinary income

1.

(Form 600S, Line J) ..............................................................................................

2. Total Income for Georgia purposes

2.

(Form 600S, Sch 8, Line 11) ................................................................

3. Net Worth

3.

(Form 600S, Sch 3, Line 4) ...........................................................................................................

4. Net Worth Taxable by Georgia

4.

(Form 600S, Sch 3, Line 6) .........................................................................

5. Tax Amounts

(Form 600S, Sch 4, Line 1) ...........

Income

..... Net Worth

6. Balance of Tax due with return

6.

(Form 600S, Sch 4, Line 10).......................................................................

7. Refund

Credited to 2011

...... Refunded

(Form 600S, Sch 4, Line 11) ...

P

I I

D

E

C

L

A

R

A

T

I

O

N

O

F

C

O

R

P

O

R

A

T

E

O

F

I F

C

E

R

ART

Under penaltiesof perjury, I declare that the information I have provided to the corporation’s ElectronicReturn Originator (ERO) and/or Online Service Provider and/or transmitter

and the amounts shown in Part I agree with the amounts shown on the correspondinglines of the electronicportion of the corporation’s 2011 Georgia CorporateIncomeTax Return.

I declarethat I haveexaminedthe corporation’s tax return,includingaccompanyingschedules and statements, and to the best of my knowledge and belief, the corporation’s return is

true, correct and complete. I consent that the electronic portion of the corporation’s return may be sent by my ERO/Online Service Provider/transmitter.

S

IGN

H

ERE

I S

G

N

A

T

U

R

E

O

F

O

F

I F

C

E

R

D

A

T

E

T

I

T

L

E

P

R

I

N

T

N

A

M

E

- E

M

A

I

L

P

III

DECLARATION OF ELECTRONIC RETURNS ORIGINATOR AND PAID PREPARER

ART

I DECLARE THAT I HAVE REVIEWED THEABOVE CORPORATION’S RETURNAND THATTHE ENTRIES ON THE GA-8453 SARE COMPLETE

AND CORRECTTO THE BEST OF MYKNOWLEDGE.

ERO’s Signature _________________________________________________________________

Date _______________________

ERO’s

Firm’s Name

__________________________________________________________________

Check if also paid preparer

Use

Address

__________________________________________________________________

Only

__________________________________________________________________

IF PREPARED BYA PERSON OTHER THAN THE TAXPAYER, THIS DECLARATION IS BASED ON ALL THE INFORMATION OF WHICH

THE TAXPAYER HAS KNOWLEDGE.

Paid Preparer’s Signature _________________________________________________________

Date _______________________

Paid

Firm’s Name

__________________________________________________________________

FEIN/PTIN _________________

Preparer’s

Address

__________________________________________________________________

SSN/TIN ___________________

Use Only

__________________________________________________________________

PLEASE DO NOT MAIL! KEEP WITH YOUR RECORDS

GA-8453 S (REV 8/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2