Form Wv-1096 - Annual Summary And Transmittal Of W-2g Backup Withholding On Certain Gambling Winnings

ADVERTISEMENT

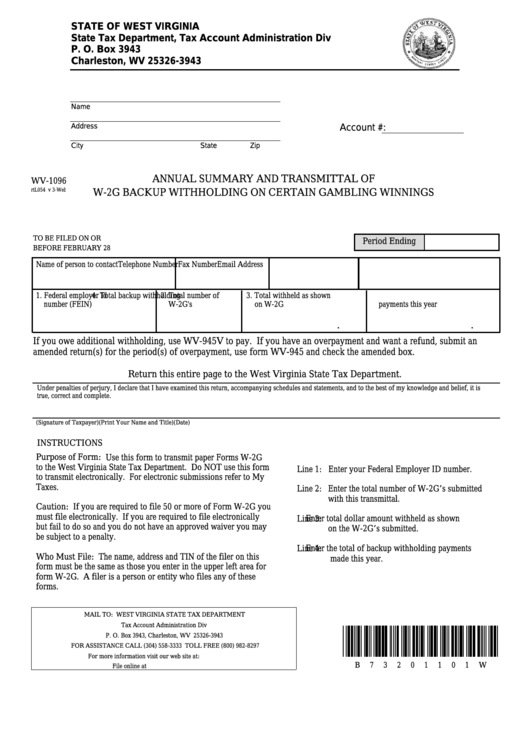

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P. O. Box 3943

Charleston, WV 25326-3943

Name

Address

Account #:

City

State

Zip

ANNUAL SUMMARY AND TRANSMITTAL OF

WV-1096

rtL054 v 3-Web

W-2G BACKUP WITHHOLDING ON CERTAIN GAMBLING WINNINGS

TO BE FILED ON OR

Period Ending

BEFORE FEBRUARY 28

Name of person to contact

Telephone Number

Fax Number

Email Address

1. Federal employer Id

2. Total number of

3. Total withheld as shown

4. Total backup withholding

number (FEIN)

W-2G's

on W-2G

payments this year

.

.

If you owe additional withholding, use WV-945V to pay. If you have an overpayment and want a refund, submit an

amended return(s) for the period(s) of overpayment, use form WV-945 and check the amended box.

Return this entire page to the West Virginia State Tax Department.

Under penalties of perjury, I declare that I have examined this return, accompanying schedules and statements, and to the best of my knowledge and belief, it is

true, correct and complete.

(Signature of Taxpayer)

(Print Your Name and Title)

(Date)

INSTRUCTIONS

Purpose of Form: Use this form to transmit paper Forms W-2G

to the West Virginia State Tax Department. Do NOT use this form

Line 1: Enter your Federal Employer ID number.

to transmit electronically. For electronic submissions refer to My

Taxes.

Line 2: Enter the total number of W-2G’s submitted

with this transmittal.

Caution: If you are required to file 50 or more of Form W-2G you

must file electronically. If you are required to file electronically

Line 3: Enter total dollar amount withheld as shown

but fail to do so and you do not have an approved waiver you may

on the W-2G’s submitted.

be subject to a penalty.

Line 4: Enter the total of backup withholding payments

Who Must File: The name, address and TIN of the filer on this

made this year.

form must be the same as those you enter in the upper left area for

form W-2G. A filer is a person or entity who files any of these

forms.

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P. O. Box 3943, Charleston, WV 25326-3943

FOR ASSISTANCE CALL (304) 558-3333 TOLL FREE (800) 982-8297

For more information visit our web site at:

B

7

3

2

0

1

1

0

1

W

File online at https://mytaxes.wvtax.gov

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1