Form A-101 - Estate Tax Return

Download a blank fillable Form A-101 - Estate Tax Return in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form A-101 - Estate Tax Return with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

4

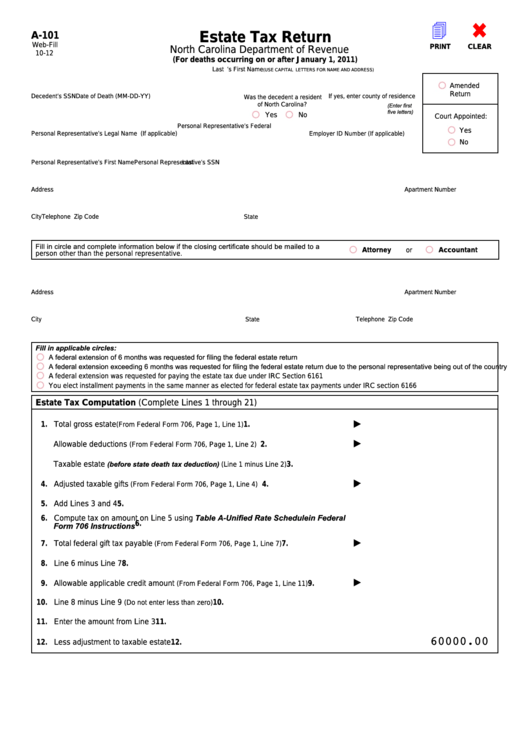

A-101

Estate Tax Return

Web-Fill

PRINT

CLEAR

North Carolina Department of Revenue

10-12

(For deaths occurring on or after January 1, 2011)

Decedent’s First Name

M.I.

Last Name

(USE CAPITAL LETTERS FOR NAME AND ADDRESS)

Amended

Return

Decedent’s SSN

Date of Death (MM-DD-YY)

If yes, enter county of residence

Was the decedent a resident

of North Carolina?

(Enter first

five letters)

Yes

No

Court Appointed:

Personal Representative’s Federal

Yes

Employer ID Number (If applicable)

Personal Representative’s Legal Name (If applicable)

No

Personal Representative’s First Name

M.I.

Last Name

Personal Representative’s SSN

Address

Apartment Number

City

State

Zip Code

Telephone

Fill in circle and complete information below if the closing certificate should be mailed to a

Attorney

or

Accountant

person other than the personal representative.

First Name

M.I.

Last Name

Address

Apartment Number

City

Zip Code

Telephone

State

Fill in applicable circles:

A federal extension of 6 months was requested for filing the federal estate return

A federal extension exceeding 6 months was requested for filing the federal estate return due to the personal representative being out of the country

A federal extension was requested for paying the estate tax due under IRC Section 6161

You elect installment payments in the same manner as elected for federal estate tax payments under IRC section 6166

Estate Tax Computation (Complete Lines 1 through 21)

1. Total gross estate

1.

(From Federal Form 706, Page 1, Line 1)

2.

Allowable deductions

2.

(From Federal Form 706, Page 1, Line 2)

(before state death tax deduction) (Line 1 minus Line 2)

3.

Taxable estate

3.

4. Adjusted taxable gifts

4.

(From Federal Form 706, Page 1, Line 4)

5. Add Lines 3 and 4

5.

6. Compute tax on amount on Line 5 using Table A-Unified Rate Schedule in Federal

6.

Form 706 Instructions

7. Total federal gift tax payable

7.

(From Federal Form 706, Page 1, Line 7)

8. Line 6 minus Line 7

8.

9. Allowable applicable credit amount

9.

(From Federal Form 706, Page 1, Line 11)

10. Line 8 minus Line 9

10.

(Do not enter less than zero)

11. Enter the amount from Line 3

11.

60000.00

12. Less adjustment to taxable estate

12.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4