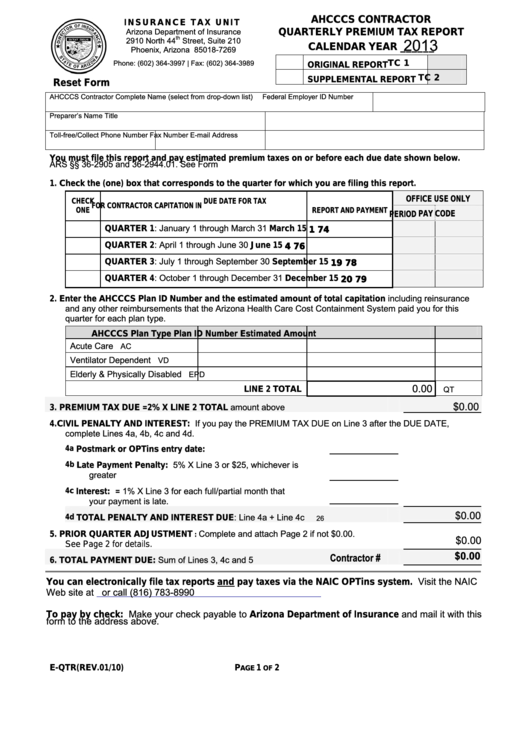

AHCCCS CONTRACTOR

I N S U R A N C E T A X U N I T

Arizona Department of Insurance

QUARTERLY PREMIUM TAX REPORT

th

2910 North 44

Street, Suite 210

2013

CALENDAR YEAR ______

Phoenix, Arizona 85018-7269

TC 1

Phone: (602) 364-3997 | Fax: (602) 364-3989

ORIGINAL REPORT

TC 2

SUPPLEMENTAL REPORT

Reset Form

AHCCCS Contractor Complete Name (select from drop-down list)

Federal Employer ID Number

Preparer’s Name

Title

Toll-free/Collect Phone Number

Fax Number

E-mail Address

You must file this report and pay estimated premium taxes on or before each due date shown below.

ARS §§ 36-2905 and 36-2944.01. See Form E-QTR.INSTRUCTION for further assistance.

1. Check the (one) box that corresponds to the quarter for which you are filing this report.

OFFICE USE ONLY

CHECK

DUE DATE FOR TAX

FOR CONTRACTOR CAPITATION IN

ONE

REPORT AND PAYMENT

PAY CODE

PERIOD

QUARTER 1: January 1 through March 31

1

74

March 15

QUARTER 2: April 1 through June 30

4

76

June 15

QUARTER 3: July 1 through September 30

19

78

September 15

QUARTER 4: October 1 through December 31

20

79

December 15

2. Enter the AHCCCS Plan ID Number and the estimated amount of total capitation including reinsurance

and any other reimbursements that the Arizona Health Care Cost Containment System paid you for this

quarter for each plan type.

AHCCCS Plan Type

Plan ID Number

Estimated Amount

Acute Care

AC

Ventilator Dependent

VD

Elderly & Physically Disabled

EPD

0.00

QT

LINE 2 TOTAL

$0.00

3. PREMIUM TAX DUE = 2% X LINE 2 TOTAL amount above

4. CIVIL PENALTY AND INTEREST: If you pay the PREMIUM TAX DUE on Line 3 after the DUE DATE,

complete Lines 4a, 4b, 4c and 4d.

4a

Postmark or OPTins entry date:

Late Payment Penalty: 5% X Line 3 or $25, whichever is

4b

greater

Interest: = 1% X Line 3 for each full/partial month that

4c

your payment is late.

$0.00

TOTAL PENALTY AND INTEREST DUE: Line 4a + Line 4c

4d

26

Complete and attach Page 2 if not $0.00.

5. PRIOR QUARTER ADJUSTMENT

:

$0.00

See Page 2 for details.

$0.00

Contractor #

6. TOTAL PAYMENT DUE: Sum of Lines 3, 4c and 5

You can electronically file tax reports and pay taxes via the NAIC OPTins system. Visit the NAIC

Web site at

or call (816) 783-8990

To pay by check: Make your check payable to Arizona Department of Insurance and mail it with this

form to the address above.

E-QTR (REV. 01/10)

P

1

2

AGE

OF

1

1 2

2