Schedule Wv/ag-1 - West Virginia Environmental Agricultural Equipment Tax Credit Information And Instructions

ADVERTISEMENT

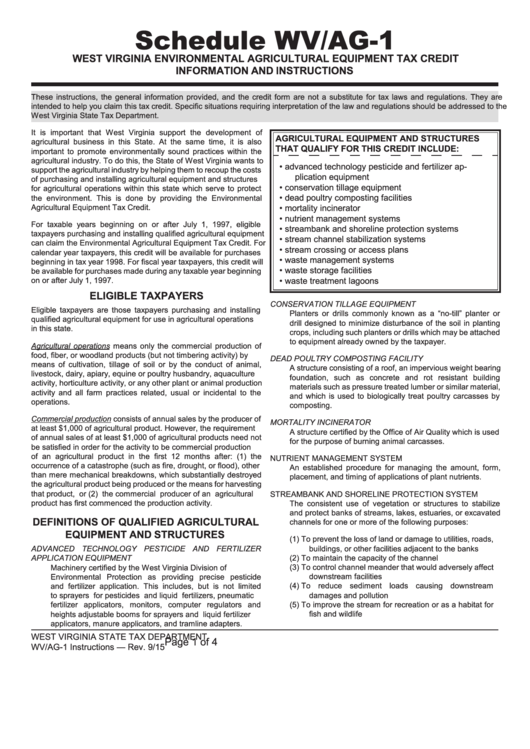

Schedule WV/AG-1

WEST VIRGINIA ENVIRONMENTAL AGRICULTURAL EQUIPMENT TAX CREDIT

INFORMATION AND INSTRUCTIONS

These instructions, the general information provided, and the credit form are not a substitute for tax laws and regulations. They are

intended to help you claim this tax credit. Specific situations requiring interpretation of the law and regulations should be addressed to the

West Virginia State Tax Department.

It is important that West Virginia support the development of

AGRICULTURAL EQUIPMENT AND STRUCTURES

agricultural business in this State. At the same time, it is also

THAT QUALIFY FOR THIS CREDIT INCLUDE:

important to promote environmentally sound practices within the

agricultural industry. To do this, the State of West Virginia wants to

•

advanced technology pesticide and fertilizer ap-

support the agricultural industry by helping them to recoup the costs

plication equipment

of purchasing and installing agricultural equipment and structures

•

conservation tillage equipment

for agricultural operations within this state which serve to protect

•

dead poultry composting facilities

the environment. This is done by providing the Environmental

Agricultural Equipment Tax Credit.

•

mortality incinerator

•

nutrient management systems

For taxable years beginning on or after July 1, 1997, eligible

•

streambank and shoreline protection systems

taxpayers purchasing and installing qualified agricultural equipment

•

stream channel stabilization systems

can claim the Environmental Agricultural Equipment Tax Credit. For

•

stream crossing or access plans

calendar year taxpayers, this credit will be available for purchases

•

waste management systems

beginning in tax year 1998. For fiscal year taxpayers, this credit will

•

waste storage facilities

be available for purchases made during any taxable year beginning

•

waste treatment lagoons

on or after July 1, 1997.

ELIGIBLE TAXPAYERS

CONSERVATION TILLAGE EQUIPMENT

Eligible taxpayers are those taxpayers purchasing and installing

Planters or drills commonly known as a “no-till” planter or

qualified agricultural equipment for use in agricultural operations

drill designed to minimize disturbance of the soil in planting

in this state.

crops, including such planters or drills which may be attached

to equipment already owned by the taxpayer.

Agricultural operations means only the commercial production of

food, fiber, or woodland products (but not timbering activity) by

DEAD POULTRY COMPOSTING FACILITY

means of cultivation, tillage of soil or by the conduct of animal,

A structure consisting of a roof, an impervious weight bearing

livestock, dairy, apiary, equine or poultry husbandry, aquaculture

foundation, such as concrete and rot resistant building

activity, horticulture activity, or any other plant or animal production

materials such as pressure treated lumber or similar material,

activity and all farm practices related, usual or incidental to the

and which is used to biologically treat poultry carcasses by

operations.

composting.

Commercial production consists of annual sales by the producer of

MORTALITY INCINERATOR

at least $1,000 of agricultural product. However, the requirement

A structure certified by the Office of Air Quality which is used

of annual sales of at least $1,000 of agricultural products need not

for the purpose of burning animal carcasses.

be satisfied in order for the activity to be commercial production

of an agricultural product in the first 12 months after: (1) the

NUTRIENT MANAGEMENT SYSTEM

occurrence of a catastrophe (such as fire, drought, or flood), other

An established procedure for managing the amount, form,

than mere mechanical breakdowns, which substantially destroyed

placement, and timing of applications of plant nutrients.

the agricultural product being produced or the means for harvesting

that product, or (2) the commercial producer of an agricultural

STREAMBANK AND SHORELINE PROTECTION SYSTEM

product has first commenced the production activity.

The consistent use of vegetation or structures to stabilize

and protect banks of streams, lakes, estuaries, or excavated

DEFINITIONS OF QUALIFIED AGRICULTURAL

channels for one or more of the following purposes:

EQUIPMENT AND STRUCTURES

(1)

To prevent the loss of land or damage to utilities, roads,

ADVANCED TECHNOLOGY PESTICIDE AND FERTILIZER

buildings, or other facilities adjacent to the banks

(2)

To maintain the capacity of the channel

APPLICATION EQUIPMENT

Machinery certified by the West Virginia Division of

(3)

To control channel meander that would adversely affect

Environmental Protection as providing precise pesticide

downstream facilities

(4)

To reduce sediment loads causing downstream

and fertilizer application. This includes, but is not limited

to sprayers for pesticides and liquid fertilizers, pneumatic

damages and pollution

(5)

To improve the stream for recreation or as a habitat for

fertilizer applicators, monitors, computer regulators and

fish and wildlife

heights adjustable booms for sprayers and liquid fertilizer

applicators, manure applicators, and tramline adapters.

WEST VIRGINIA STATE TAX DEPARTMENT

Page 1 of 4

WV/AG-1 Instructions — Rev. 9/15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4