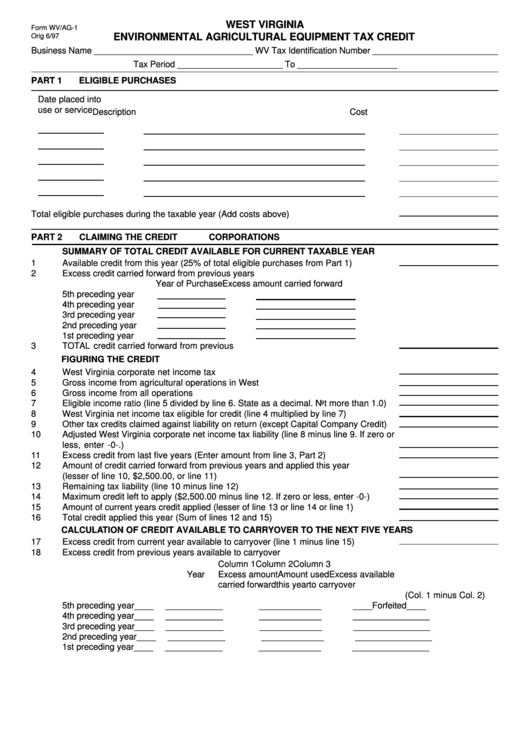

WEST VIRGINIA

Form WV/AG-1

ENVIRONMENTAL AGRICULTURAL EQUIPMENT TAX CREDIT

Orig 6/97

Business Name _________________________________ WV Tax Identification Number __________________________

Tax Period ______________________ To _____________________

PART 1

ELIGIBLE PURCHASES

Date placed into

use or service

Description

Cost

Total eligible purchases during the taxable year (Add costs above).............................................

PART 2

CLAIMING THE CREDIT

CORPORATIONS

SUMMARY OF TOTAL CREDIT AVAILABLE FOR CURRENT TAXABLE YEAR

1

Available credit from this year (25% of total eligible purchases from Part 1)....................

2

Excess credit carried forward from previous years

Year of Purchase

Excess amount carried forward

5th preceding year

4th preceding year

3rd preceding year

2nd preceding year

1st preceding year

3

TOTAL credit carried forward from previous years..........................................................

FIGURING THE CREDIT

4

West Virginia corporate net income tax .........................................................................

5

Gross income from agricultural operations in West Virginia............................................

6

Gross income from all operations everywhere................................................................

7

Eligible income ratio (line 5 divided by line 6. State as a decimal. Not more than 1.0)....

8

West Virginia net income tax eligible for credit (line 4 multiplied by line 7).....................

9

Other tax credits claimed against liability on return (except Capital Company Credit).....

10

Adjusted West Virginia corporate net income tax liability (line 8 minus line 9. If zero or

less, enter -0-.)..............................................................................................................

11

Excess credit from last five years (Enter amount from line 3, Part 2)..............................

12

Amount of credit carried forward from previous years and applied this year

(lesser of line 10, $2,500.00, or line 11)..........................................................................

13

Remaining tax liability (line 10 minus line 12).................................................................

14

Maximum credit left to apply ($2,500.00 minus line 12. If zero or less, enter -0-)............

15

Amount of current years credit applied (lesser of line 13 or line 14 or line 1)...................

16

Total credit applied this year (Sum of lines 12 and 15)....................................................

CALCULATION OF CREDIT AVAILABLE TO CARRYOVER TO THE NEXT FIVE YEARS

17

Excess credit from current year available to carryover (line 1 minus line 15)...................

18

Excess credit from previous years available to carryover

Column 1

Column 2

Column 3

Year

Excess amount

Amount used

Excess available

carried forward

this year

to carryover

(Col. 1 minus Col. 2)

5th preceding year

____

____________

_____________

____Forfeited____

4th preceding year

____

____________

_____________

________________

3rd preceding year

____

____________

_____________

________________

2nd preceding year

____

____________

_____________

________________

1st preceding year

____

____________

_____________

________________

1

1 2

2 3

3