Instructions For Form Sc1040 - 2011

ADVERTISEMENT

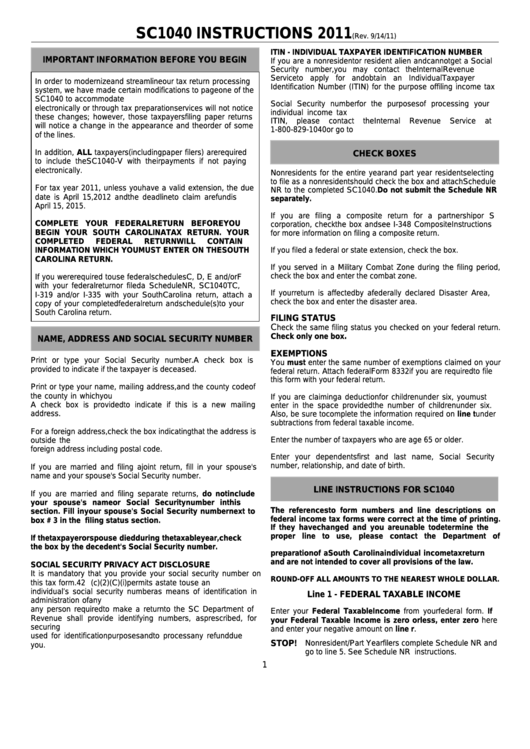

SC1040 INSTRUCTIONS 2011

(Rev. 9/14/11)

ITIN - INDIVIDUAL TAXPAYER IDENTIFICATION NUMBER

IMPORTANT INFORMATION BEFORE YOU BEGIN

If you are a nonresident or resident alien and cannot get a Social

Security number, you may contact the

Internal

Revenue

Service

to apply for and obtain an Individual Taxpayer

In order to modernize and streamline our tax return processing

Identification Number (ITIN) for the purpose of filing income tax

system, we have made certain modifications to page one of the

returns. South Carolina will accept this number in place of a

SC1040 to accommodate barcode information. Taxpayers filing

Social Security number for the purposes of processing your

electronically or through tax preparation services will not notice

individual income tax returns. For information on obtaining an

these changes; however, those taxpayers filing paper returns

ITIN,

please

contact

the

Internal

Revenue

Service

at

will notice a change in the appearance and the order of some

1-800-829-1040 or go to

of the lines.

In addition, ALL taxpayers (including paper filers) are required

CHECK BOXES

to include the SC1040-V with their payments if not paying

electronically.

Nonresidents for the entire year and part year residents electing

to file as a nonresident should check the box and attach Schedule

For tax year 2011, unless you have a valid extension, the due

NR to the completed SC1040. Do not submit the Schedule NR

date is April 15, 2012 and the deadline to claim a refund is

separately.

April 15, 2015.

If you are filing a composite return for a partnership or S

COMPLETE YOUR FEDERAL RETURN BEFORE YOU

corporation, check the box and see I-348 Composite Instructions

BEGIN YOUR SOUTH CAROLINA TAX RETURN. YOUR

for more information on filing a composite return.

COMPLETED

FEDERAL

RETURN

WILL

CONTAIN

INFORMATION WHICH YOU MUST ENTER ON THE SOUTH

If you filed a federal or state extension, check the box.

CAROLINA RETURN.

If you served in a Military Combat Zone during the filing period,

check the box and enter the combat zone.

If you were required to use federal schedules C, D, E and/or F

with your federal return or filed a Schedule NR, SC1040TC,

If your return is affected by a federally declared Disaster Area,

I-319 and/or I-335 with your South Carolina return, attach a

check the box and enter the disaster area.

copy of your completed federal return and schedule(s) to your

South Carolina return.

FILING STATUS

C

heck the same filing status you checked on your federal return.

.

Check only one box

NAME, ADDRESS AND SOCIAL SECURITY NUMBER

EXEMPTIONS

Print or type your Social Security number. A check box is

You must enter the same number of exemptions claimed on your

provided to indicate if the taxpayer is deceased.

federal return. Attach federal Form 8332 if you are required to file

this form with your federal return.

Print or type your name, mailing address, and the county code of

the county in which you live. See county code listing on page 9.

If you are claiming a deduction for children under six, you must

A check box is provided to indicate if this is a new mailing

enter in the space provided the number of children under six.

address.

Also, be sure to complete the information required on line t under

subtractions from federal taxable income.

For a foreign address, check the box indicating that the address is

Enter the number of taxpayers who are age 65 or older.

outside the US. In the box provided print or type the complete

foreign address including postal code.

Enter your dependents first and last name, Social Security

number, relationship, and date of birth.

If you are married and filing a joint return, fill in your spouse's

name and your spouse's Social Security number.

LINE INSTRUCTIONS FOR SC1040

If you are married and filing separate returns, do not include

your spouse's name or Social Security number in this

The references to form numbers and line descriptions on

section. Fill in your spouse's Social Security number next to

federal income tax forms were correct at the time of printing.

box # 3 in the filing status section.

If they have changed and you are unable to determine the

proper line to use, please contact the Department of

If the taxpayer or spouse died during the taxable year, check

Revenue. These instructions are to be used as a guide in the

the box by the decedent's Social Security number.

preparation of a South Carolina individual income tax return

and are not intended to cover all provisions of the law.

SOCIAL SECURITY PRIVACY ACT DISCLOSURE

It is mandatory that you provide your social security number on

ROUND-OFF ALL AMOUNTS TO THE NEAREST WHOLE DOLLAR.

this tax form. 42 U.S.C. 405(c)(2)(C)(i) permits a state to use an

individual’s social security number as means of identification in

Line 1 - FEDERAL TAXABLE INCOME

administration of any tax. SC Regulation 117-201 mandates that

any person required to make a return to the SC Department of

Enter your Federal Taxable Income from your federal form. If

Revenue shall provide identifying numbers, as prescribed, for

your Federal Taxable Income is zero or less, enter zero here

securing proper identification. Your social security number is

and enter your negative amount on line r.

used for identification purposes and to process any refund due

STOP!

Nonresident/Part Year filers complete Schedule NR and

you.

go to line 5. See Schedule NR instructions.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9