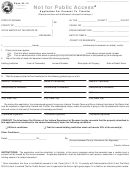

Preparing Applications for Consents to Transfer (Form IH-14)

INSTRUCTIONS FOR PERSONAL REPRESENTATIVES, JOINT OWNERS, OR OTHER BENEFICIARES WISHING TO

OBTAIN CONSENT TO TRANSFER PERSONAL PROPERTY OF AN INDIANA RESIDENT DECEDENT

1. Complete all information concerning the decedent’s name, county of residence, social security number, date of death

and address at the top of the form.

2. For number one (1), please check box A and list the name of the personal representative if you have opened a probate

estate. Complete the cause number and date the estate was opened. If no probate estate has been opened and no

administration is anticipated, leave the cause number blank and check box B.

3. Complete all account information. Be sure to list the value of the account on the decedent’s date of death. Multiple

accounts held by the same holding institution (e.g. bank, brokerage, insurance company) may be reported on the same

form. Use separate forms for each holding institution.

4. Complete all transferee information including name, relationship to decedent, address, telephone number and email

address.

5. Signatures - If the estate is the beneficiary, the personal representative should sign the Consent to Transfer. If a trust is

the beneficiary, the trustee should sign the Consent to Transfer. For jointly held property and payable on death accounts,

all joint owners or beneficiaries must sign – separate forms can be used. Original signatures are preferred, but faxed or

scanned signatures are acceptable. The county assessor will complete the bottom portion of the form. **

6. File the completed forms in triplicate at the county assessor’s office in the county where the decedent was a

resident.

7. If submitting the application by mail, please enclose a self-addressed stamped envelope.

8. The assessor will return two (2) copies of the consent to you: one to send to the holding institution and one for your

personal records.

*Once completed, this form is confidential pursuant to Ind. Code § 6-4.1-12-12. To comply with Administrative Rule 9 and

Trial Rule 5(G) this form is marked “Not for Public Access” and is required to be filed with the county assessor on light green

paper if it is filed for an otherwise public estate.

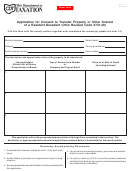

**Where the value of a jointly-owned asset exceeds a transferee’s exemption amount, the county assessor may authorize

the holding institution to withhold 20% of the jointly-owned asset’s value to insure that the transfer does not jeopardize

the collection of Indiana Inheritance Tax.

Once the county assessor has determined that all taxes have been paid on

the transfer or an Indiana Inheritance Tax Return has been filed, the remaining funds may be released. You may need to

provide a copy of the Inheritance Tax Closing letter and/or the countersigned receipt to the holding institution to complete

the transfer; however the holding institution may require an additional Application for Consent to Transfer to be filed in order

to release the remaining funds.

**Where the value of other assets (not jointly-owned) exceeds a transferee’s exemption amount, the county assessor may

decline to consent to the transfer and instead ask you or your attorney to file an Indiana Inheritance Tax Return (Form IH-6)

or for you to pay the inheritance tax on the transfer. Once the county assessor has determined that all taxes have been

paid on the transfer or an Indiana Inheritance Tax Return has been filed, the county assessor may consent to the transfer

by signing and dating the bottom of the Consent to Transfer (Form IH-14).

1

1 2

2