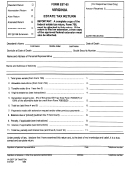

Form Sc706c - Resident/nonresident Estate Tax Return Page 2

ADVERTISEMENT

SC706C INSTRUCTIONS

Instructions for filing form SC706C. These instructions are applicable only to decedents dying on or after July 1, 1991.

"Federal Credit" means the maximum amount of the credit for state death taxes allowable by Internal Revenue Code Section 2011.

The term, "maximum amount" must be construed so as to take full advantage of the credit as allowable by the Internal Revenue Code.

RULES AND REGULATIONS: Such rules and regulations promulgated for use in determining the taxable estate for federal purposes,

exempting therefrom such federal rules and regulations as are in conflict with South Carolina law, will be used by the SC Department

of Revenue in conjunction with rules and regulations promulgated by the Department of Revenue in determining the taxable estate for

South Carolina estate tax purposes.

NOTE: Section 12-54-70 requires that you file a tentative return and remit one hundred percent (100%) of the anticipated tax, unless

a hardship extension under Section 12-16-1140 is being requested. If a federal extension is requested, attach a copy of the federal

extension.

GENERAL INFORMATION: The South Carolina Estate Tax is imposed by Chapter 16, of the South Carolina Code of Laws, 1976, as

amended. It is imposed upon the transfer of the entire taxable estate and not upon the share received by a particular beneficiary.

NONRESIDENTS: In the case of a nonresident decedent, the state death tax credit is allowed on a pro rata basis in such proportion

as property having situs in this State relates to property elsewhere.

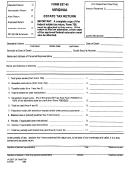

ESTATE FOR WHICH RETURNS ARE REQUIRED: Form SC706 or SC706C must be filed for every resident and SC706NR or

SC706C for every nonresident of the State of South Carolina whose gross estate as defined by statute exceeds the applicable filing

requirement at the date of death, regardless of situs. (See Chart.)

DATE OF DEATH

FILING REQUIREMENT

FORM

July 1, 1991 - Dec. 31, 1997

$600,000

SC706C along with federal 706

Jan. 1, 1998 - Dec. 31, 1998

$625,000

SC706C along with federal 706

Jan. 1,1999 - Dec. 31, 1999

$650,000

SC706C along with federal 706

Jan. 1, 2000 - Dec. 31, 2001

$675,000

SC706C along with federal 706

Jan. 1, 2002 - Dec. 31, 2003

$1,000,000

SC706C along with federal 706

Jan. 1, 2004 - Dec. 31, 2004

$1,500,000

SC706C along with federal 706

Jan. 1, 2005 - No SC Estate Tax

DUE DATE: The return is due and any tax liability is payable on or before 9 months from the date of death.

PLACE OF FILING: The return must be filed with the SC Department of Revenue, Estate Tax, PO Box 125, Columbia, SC

29214-0061.

SUPPLEMENTAL DOCUMENTS: IRS Form 706 must be attached to this form. Also, a certified copy of the will and a death

certificate must be filed with the return. Other supplemental documents may be required, for example, Forms 712 and 709, trusts and

powers of appointment instruments. If you do not file these documents with the return, the processing of the return will be delayed.

SIGNATURE AND VERIFICATION: The Personal Representative(s) should verify and sign the return in the space provided on the

reverse page. In all cases, the person(s) liable for filing the return must sign together with attorney, accountant or agent preparing the

return.

PENALTIES: Chapter 54, South Carolina Code of Laws, 1976, as amended, imposes penalties for both delinquent returns and for

delinquent payment of tax unless due to reasonable cause. The law also provides penalties for willful failure to file a return on time and

or willful attempt to evade or defeat payment of tax. Interest must be charged at the rate provided under Internal Revenue Code

Section 6621 and 6622.

REAL ESTATE WAIVERS: If a personal representative desires to transfer real property prior to the closing of an estate, a legal

description and a copy of the sales contract of the property must be submitted in duplicate to the Office Services Division on Form

SC4422. The real estate waiver may be approved, depending upon the particular circumstances of the estate. If the case of a real

estate waiver for a nonresident, 8% of the gross sales price must be withheld from the sale.

A COPY OF THE FEDERAL CLOSING LETTER MUST BE PROVIDED TO THE SC DEPARTMENT OF REVENUE IN ORDER FOR

THE SOUTH CAROLINA CLOSING LETTER TO BE ISSUED.

If an amended Federal Estate Tax Return is filed, an amended South Carolina Estate Tax Return must immediately be filed together

with a copy of the amended Federal Estate Tax Return and payment of any additional tax plus interest.

Written notice of final determination of the Federal Estate Tax which contains any adjustments must be given within 60 days of the

determination together with payment of any additional tax plus interest.

33062019

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2