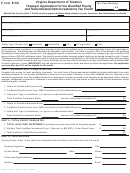

Form Wv/fiia-Tcs - Schedule Fiia-Tcs West Virginia Film Industry Investment Tax Credit Page 2

ADVERTISEMENT

WV/FIIA-TCS

WEST VIRGINIA STATE TAX DEPARTMENT

Org. 01/2009

SCHEDULE FIIA-TCS

WEST VIRGINIA FILM INDUSTRY INVESTMENT TAX CREDIT

I

I

I

I

I

I

I I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I I

I

I

I I

I

I

I

I

CREDIT CLAIMANT NAME

CREDIT CLAIMANT ID (EIN/SSN)

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

TAX PERIOD BEGINNING

ENDING

MM

DD

YYYY

MM

DD

YYYY

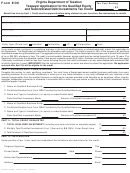

13.

Credit Available This Period Adjusted for Business Franchise Tax Offset (Subtract the amount on

Line 12e from the amount on Line 11).

14.

Corporation Net Income Tax

a.

Enter total Corporation Net Income Tax Liability.

a.

b.

Corporation Net Income Tax Film Industry Investment Tax Credit Offset

(Enter the lesser of the amount on Line 13 and the amount on Line 14a.

b.

Also enter this amount on Schedule TC on form WV/CNF-120).

15.

Credit Available This Period Adjusted for Corporation Net Income Tax Offset (Subtract the amount

on Line 14b from the amount on Line 13).

16.

Personal Income Tax

a.

a.

Enter total Personal Income Tax Liability

b.

Personal Income Tax Film Industry Investment Tax Credit Offset (Enter the lesser

b.

of the amount on Line 15 and the amount on Line 16a. Also enter this amount

on the Tax Credit Recap Schedule on form IT-140).

Part C - Credit Recap

(A) Beginning

(B) Film industry

(C) Film industry

(D) Film industry

(E) Film industry

(F) Film industry

(G) Ending Balance of Total Available

Balance of Total

Investment Tax Credit

Investment Tax Credit

Investment Tax Credit

Investment Tax Credit

Investment Tax Credit

Film Industry Investment Tax Credit

Tax Year Ending

Available Film Industry

Applied to Business

Applied to Corporation

Applied to Personal

Allocated to Owners

Sold or Transferred

(Column A minus the sum of Columns B

(mm/dd/yyyy)

Investment Tax Credit

Franchise Tax

Net Income Tax

Income Tax

through F)

Notes:

No Film Industry Investment Tax Credit is allowed after the expiration of the second taxable year after the taxable year in which the

expenditures upon which the credit is based occurred.

The transfer or sale of the Film Industry Investment Tax Credit does not extend the time in which the credit can be used. The carry

forward period for credit that is transferred or sold begins on the date on which the credit was originally granted by the West Virginia

Film Office.

No carryback to a prior year is allowed for the amount of any unused portion of any annual credit allowance.

Signature of Taxpayer

Name of Taxpayer: Type or Print

Title

Date

Person to Contact Concerning this Return

Telephone Number

Signature of Preparer other than Taxpayer

Address

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2