City Of Dawson Springs, Kentucky Net Profit License Fee Return Instructions

ADVERTISEMENT

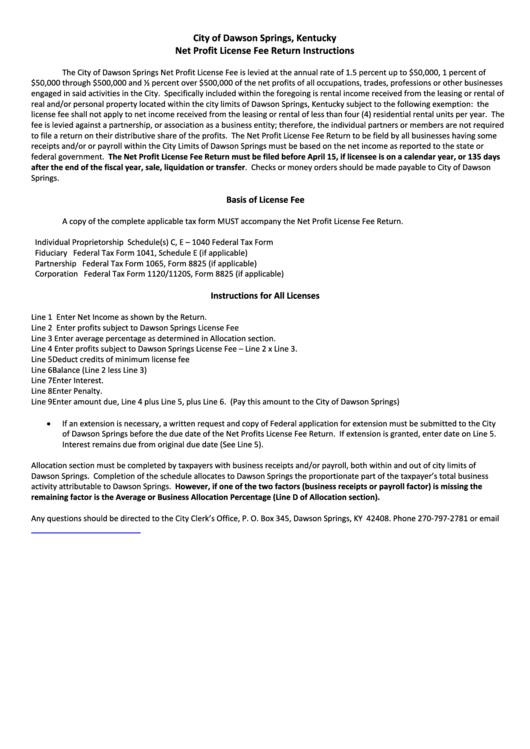

City of Dawson Springs, Kentucky

Net Profit License Fee Return Instructions

The City of Dawson Springs Net Profit License Fee is levied at the annual rate of 1.5 percent up to $50,000, 1 percent of

$50,000 through $500,000 and ½ percent over $500,000 of the net profits of all occupations, trades, professions or other businesses

engaged in said activities in the City. Specifically included within the foregoing is rental income received from the leasing or rental of

real and/or personal property located within the city limits of Dawson Springs, Kentucky subject to the following exemption: the

license fee shall not apply to net income received from the leasing or rental of less than four (4) residential rental units per year. The

fee is levied against a partnership, or association as a business entity; therefore, the individual partners or members are not required

to file a return on their distributive share of the profits. The Net Profit License Fee Return to be field by all businesses having some

receipts and/or or payroll within the City Limits of Dawson Springs must be based on the net income as reported to the state or

federal government. The Net Profit License Fee Return must be filed before April 15, if licensee is on a calendar year, or 135 days

after the end of the fiscal year, sale, liquidation or transfer. Checks or money orders should be made payable to City of Dawson

Springs.

Basis of License Fee

A copy of the complete applicable tax form MUST accompany the Net Profit License Fee Return.

Individual Proprietorship

Schedule(s) C, E – 1040 Federal Tax Form

Fiduciary

Federal Tax Form 1041, Schedule E (if applicable)

Partnership

Federal Tax Form 1065, Form 8825 (if applicable)

Corporation

Federal Tax Form 1120/1120S, Form 8825 (if applicable)

Instructions for All Licenses

Line 1 Enter Net Income as shown by the Return.

Line 2 Enter profits subject to Dawson Springs License Fee

Line 3 Enter average percentage as determined in Allocation section.

Line 4 Enter profits subject to Dawson Springs License Fee – Line 2 x Line 3.

Line 5 Deduct credits of minimum license fee

Line 6 Balance (Line 2 less Line 3)

Line 7 Enter Interest.

Line 8 Enter Penalty.

Line 9 Enter amount due, Line 4 plus Line 5, plus Line 6. (Pay this amount to the City of Dawson Springs)

If an extension is necessary, a written request and copy of Federal application for extension must be submitted to the City

of Dawson Springs before the due date of the Net Profits License Fee Return. If extension is granted, enter date on Line 5.

Interest remains due from original due date (See Line 5).

Allocation section must be completed by taxpayers with business receipts and/or payroll, both within and out of city limits of

Dawson Springs. Completion of the schedule allocates to Dawson Springs the proportionate part of the taxpayer’s total business

activity attributable to Dawson Springs. However, if one of the two factors (business receipts or payroll factor) is missing the

remaining factor is the Average or Business Allocation Percentage (Line D of Allocation section).

Any questions should be directed to the City Clerk’s Office, P. O. Box 345, Dawson Springs, KY 42408. Phone 270-797-2781 or email

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1