City Of Cave City, Kentucky Net Profits License Fee Return Instructions

ADVERTISEMENT

CITY OF CAVE CITY, KENTUCKY

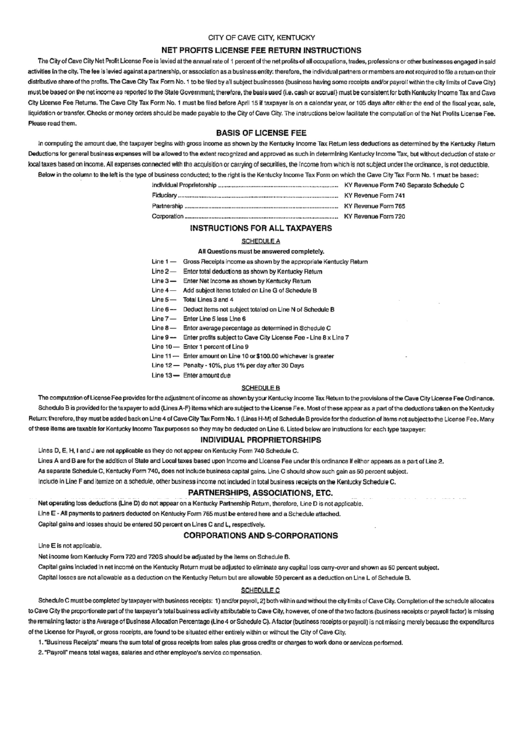

NET PROFITS LICENSE FEE RETURN INSTRUCTIONS

The City of Cave City Net Profit License Fee is levied atthe annual rate of 1 percent of the net profits of all occupations, trades, professions orother businesses engaged in said

activities in the city. The fee is levied against a partnership, or association as a business entity: therefore, the individual partners or members are not required to file a return on their

distributive share of the profits. The Cave City Tax Form No. 1 to be filed by all subject businesses (business having some receipts and/or payroll within the city limits of Cave City)

must be based on the net income as reported to the State Government; therefore, the basis used (i.e. cash or accrual) must be consistent for both Kentucky Income Tax and Cave

City License Fee Returns. The Cave City Tax Form No. I must be filed before April 15 if taxpayer is on a calendar year, or 105 days after either the end of the fiscal year, sale,

liquidation ortransfer. Checks or money orders should be made payable to the City of Cave City. The instructions below facilitate the computation of the Net Profits License Fee.

Please read them.

BASIS OF LICENSE FEE

In computing the amount due, the taxpayer begins with gross income as shown by the Kentucky Income Tax Retum less deductions as determined by the Kentucky Return

Deductions for general business expenses will be allowed to the extent recognized and approved as such in determining Kentucky Income Tax, but without deduction ot state or

local taxes based on income. All expenses connected with the acquisition or carrying of securities, the income from which is not subject under the ordinance, is not deductible.

Below in the column to the left is the type of business conducted; to the right is the Kentucky Income Tax Form on which the Cave City Tax Form No. 1 must be based:

Individual Proprietorship

KY Revenue Form 740 Separate Schedule C

Fiduciary

KY Revenue Form 741

Partnership

KY Revenue Form 765

Corporation

KY Revenue Form 720

INSTRUCTIONS FOR ALL TAXPAYERS

SCHEDULE A

All Questions must be answered completely.

Line I

—

Gross Receipts income as shown by the appropriate Kentucky Return

Line 2—

Enter total deductions as shown by Kentucky Return

Line 3—

Enter Net Income as shown by Kentucky Return

Line 4— Add subject items totaled on Line G of Schedule B

Lines— Total Lines 3 and 4

Line 6—

Deduct items not subject totaled on Line N of Schedule B

Line 7—

Enter Line 5 less Line 6

Line S

—

Enter average percentage as determined in Schedule C

LineS—

Enter profits subject to Cave City License FeeS Line Sx Line 7

Line 10

—

Enter 1 percent of Line 9

Line 11

—

Enter amount on Line 10 or $100.00 whichever is greater

Line 12— Penalty~10%. plus 1% per day after 30 Days

Line 13— Enteramountdue

SCHEDULE B

The computation of License Fee provides forthe adjustment of income as shown byyour Kentucky Income Tax Return tothe provisions of the Cave City License Fee Ordinance.

Schedule B is provided forthetaxpayerto add (Lines A-F) items which are subjecttothe License Fee. Most olthese appearas a part of the deductionstaken on the Kentucky

Return; therefore, they must be added back on Line 4 of Cave City Tax Form No.1 (Lines H’M) of Schedule B provide forthe deduction of items not subjectto the License Fee. Many

of these items are taxable for Kentucky Income Tax purposes so they may be deducted on Line 6. Listed below are instructions for each type taxpayer:

INDIVIDUAL PROPRIETORSHIPS

Lines D, E, H. I and J are not applicable as they do not appear on Kentucky Form 740 Schedule C.

Lines A and B are for the addition of State and Local taxes based upon Income and License Fee under this ordinance if either appears as a part of Line 2.

As separate Schedule C, Kentucky Form 740, does not include business capital gains. Line C should show such gain as 50 percent subject.

Include in Line F and itemize on a schedule, other business income not included in total business receipts on the Kentucky Schedule C.

PARTNERSHIPS, ASSOCIATIONS, ETC.

Net operating loss deductions (Line D) do not appear on a Kentucky Partnership Retum, therefore, LineD is not applicable.

Line E

.

All payments to partners deducted on Kentucky Form 765 must be entered here and a Schedule attached.

Capital gains and losses should be entered 50 percent on Lines C and L, respectively.

CORPORATIONS AND S-CORPORATIONS

Line E is not applicable.

Net Income from Kentucky Form 720 and 720S should be adjusted by the items on Schedule B.

Capital gains included in net income on the Kentucky Return must be adjusted to eliminate any capital loss carry-over and shown as 50 percent subject.

Capital losses are not allowable as a deduction on the Kentucky Return but are allowable 50 percent as a deduction on Line L of Schedule B.

SCHEDULE C

Schedule C must be completed by taxpayerwith business receipts: I) and/or payroll, 2) both within and without the city limits of Cave City. Completion of the schedule allocates

to Cave City the proportionate part of the taxpayer’s total business activity attributable to Cave City, however, of one of the two factors (business receipts or payroll factor) is missing

the remaining factor is the Average of Business Allocation Percentage (Line 4 or Schedule C). Afactor (business receipts or payroll) is not missing merely because the expenditures

of the License for Payroll, or gross receipts, are found to be situated either entirely within or without the City of Cave City.

-

~8usiness Receipts” means the sum total of gross receipts from sales plus gross credits or charges to work done or services performed.

2. Payroll” means total wages, salaries and other employee’s service compensation.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1