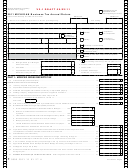

Form 4590 Draft - Michigan Business Tax Annual Return For Financial Institutions - 2008 Page 2

ADVERTISEMENT

Form 4590, Page 2

FEIN or TR Number

00

28. Recapture of certain Michigan Business Tax credits from Form 4587, line 5 .......................................................

28.

00

29. Total Tax Liability. Add lines 27 and 28 .............................................................................................................

29.

PART 2: PAYMENTS, REFUNDABLE CREDITS AND TAX

00

30. Overpayment credited from 2007 Single Business Tax ...................................

30.

00

31. Estimated tax payments ..................................................................................

31.

00

32. Tax paid with request for extension .................................................................

32.

00

33. Refundable credits from Form 4574, line 18 ...................................................

33.

34. Total Payments. Add lines 30 through 33. (If not amending, skip to line 36) .......................................................

34.

00

a. Payment made with the original return .................................

00

35a.

AMENDED

35.

b. Refund received with the original return ...............................

RETURN

00

35b.

ONLY

c. Add lines 34 and 35a and subtract line 35b from the sum ... .................................................... 35c.

00

00

36. TAX DUE. Subtract line 34 (or line 35c, if amending) from line 29. If less than zero, leave blank .......................

36.

00

37. Underpaid estimate penalty and interest from Form 4582, line 38 ........................................................................

37.

00

38. Annual return penalty at _________% = $____________ plus interest of $____________. Enter total ..............

38.

00

39. PAYMENT DUE. If line 36 is blank, go to line 40. Otherwise, add lines 36 through 38 .......................................

39.

PART 3: REFUND OR CREDIT FORWARD

40. Overpayment. Subtract lines 36, 37 and 38 from line 34 (or line 35c, if amending). If less than zero, leave

00

blank. (See instructions) ........................................................................................................................................

40.

00

41. CREDIT FORWARD. Amount of overpayment on line 40 to be credited forward .................................................

41.

00

42. REFUND. Amount of overpayment on line 40 to be refunded ...............................................................................

42.

Taxpayer Certifi cation.

Preparer Certifi cation.

I declare under penalty of perjury that the information in

I declare under penalty of perjury that this

this return and attachments is true and complete to the best of my knowledge.

return is based on all information of which I have any knowledge.

Preparer’s PTIN, FEIN or SSN

By checking this box, I authorize Treasury to discuss my return with my preparer.

Taxpayer Signature

Preparer’s Business Name (print or type)

Taxpayer Name (print or type)

Date

Preparer’s Business Address and Telephone Number (print or type)

Title

Telephone Number

(

)

Return is due April 30 or on or before the last day of the 4th month after the close of the tax year.

Make check payable to “State of

WITHOUT PAYMENT - Mail return to:

WITH PAYMENT - Pay amount on line 39

Michigan.” Print the FEIN or TR Number

and mail check and return to:

and “MBT” on the front of the check. Do

Michigan Department of Treasury

Michigan Department of Treasury

not staple the check to the return.

P.O. Box 30783

P.O. Box 30113

Lansing, MI 48909

Lansing, MI 48909

+

0000 2008 87 02 27 0

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2