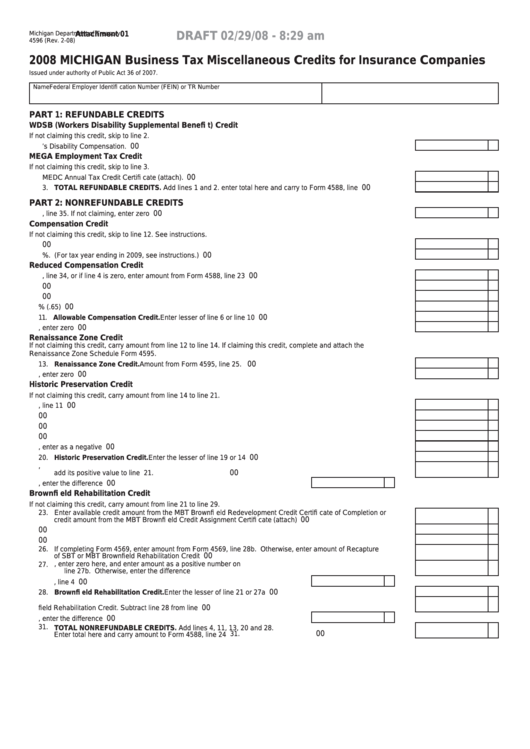

Michigan Department of Treasury

DRAFT 02/29/08 - 8:29 am

Attachment 01

4596 (Rev. 2-08)

2008 MICHIGAN Business Tax Miscellaneous Credits for Insurance Companies

Issued under authority of Public Act 36 of 2007.

Name

Federal Employer Identifi cation Number (FEIN) or TR Number

PART 1: REFUNDABLE CREDITS

WDSB (Workers Disability Supplemental Benefi t) Credit

If not claiming this credit, skip to line 2.

00

1. WDSB Credit allowed by the Bureau of Worker’s Disability Compensation. ...........................................................

1.

MEGA Employment Tax Credit

If not claiming this credit, skip to line 3.

00

2. Credit amount from MEDC Annual Tax Credit Certifi cate (attach). .........................................................................

2.

00

3. TOTAL REFUNDABLE CREDITS. Add lines 1 and 2. enter total here and carry to Form 4588, line 48...............

3.

PART 2: NONREFUNDABLE CREDITS

00

4. Single Business Tax credit carryforward from Form 4569, line 35. If not claiming, enter zero ................................

4.

Compensation Credit

If not claiming this credit, skip to line 12. See instructions.

00

5. Michigan Compensation ..........................................................................................................................................

5.

00

6. Compensation Credit. Multiply line 5 by 0.296%. (For tax year ending in 2009, see instructions.) ........................

6.

Reduced Compensation Credit

00

7. Tax before credits from Form 4569, line 34, or if line 4 is zero, enter amount from Form 4588, line 23 .................

7.

00

8. WDSB Credit from line 1 above...............................................................................................................................

8.

00

9. Subtract line 8 from line 7 ........................................................................................................................................

9.

00

10. Multiply line 9 by 65% (.65) .....................................................................................................................................

10.

00

11. Allowable Compensation Credit. Enter lesser of line 6 or line 10 ........................................................................

11.

00

12. Tax after Compensation Credit. Subtract line 11 from line 7. If less than zero, enter zero ......................................

12.

Renaissance Zone Credit

If not claiming this credit, carry amount from line 12 to line 14. If claiming this credit, complete and attach the

Renaissance Zone Schedule Form 4595.

00

13. Renaissance Zone Credit. Amount from Form 4595, line 25. ..............................................................................

13.

00

14. Tax After Renaissance Zone Credit. Subtract line 13 from line 12. If less than zero, enter zero ............................

14.

Historic Preservation Credit

If not claiming this credit, carry amount from line 14 to line 21.

00

15. Current Year Credit. Enter amount from Form 3581, line 11 ...................................................................................

15.

00

16. Unused credit from previous period MBT return ......................................................................................................

16.

00

17. Total Available Credit. Add lines 15 and 16 .............................................................................................................

17.

00

18. Recapture of SBT and/or MBT Historic Preservation Credits ..................................................................................

18.

00

19. Subtract line 18 from line 17. If less than zero, enter as a negative number...........................................................

19.

00

20. Historic Preservation Credit. Enter the lesser of line 19 or 14 .............................................................................

20.

21. Tax after Historic Preservation Credit. Subtract line 20 from line 14. If line 20 is negative,

00

add its positive value to line 14................................................................................................................................

21.

00

22. Credit forward. If line 19 is greater than line 14, enter the difference ................

22.

Brownfi eld Rehabilitation Credit

If not claiming this credit, carry amount from line 21 to line 29.

23. Enter available credit amount from the MBT Brownfi eld Redevelopment Credit Certifi cate of Completion or

00

credit amount from the MBT Brownfi eld Credit Assignment Certifi cate (attach) .....................................................

23.

00

24. Unused credit from previous MBT return .................................................................................................................

24.

00

25. Total Available Credit. Add lines 23 and 24 .............................................................................................................

25.

26. If completing Form 4569, enter amount from Form 4569, line 28b. Otherwise, enter amount of Recapture

00

of SBT or MBT Brownfi eld Rehabilitation Credit ......................................................................................................

26.

27. a. Subtract line 26 from line 25. If less than zero, enter zero here, and enter amount as a positive number on

line 27b. Otherwise, enter the difference .......................................................................................................... 27a.

00

00

b. Carry amount to Form 4587, line 4 .............................................................. 27b.

00

28. Brownfi eld Rehabilitation Credit. Enter the lesser of line 21 or 27a ....................................................................

28.

00

29. Tax After Brownfi eld Rehabilitation Credit. Subtract line 28 from line 21.................................................................

29.

00

30. Credit Forward. If line 27a is greater than line 21, enter the difference .............

30.

31. TOTAL NONREFUNDABLE CREDITS. Add lines 4, 11, 13, 20 and 28.

00

31.

Enter total here and carry amount to Form 4588, line 24 ........................................................................................

1

1