Instructions For Arizona Form 120w - Estimated Tax Worksheet For Corporations - 2011 Page 2

ADVERTISEMENT

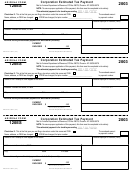

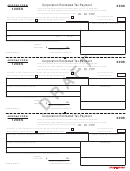

Arizona Form 120W

Form 120S: Enter the smaller of line 2a or line 2c (if an

If line 2b is less than line 2a:

amount was entered on line 2c).

Enter 25 percent of line 2b in column (a) of line 4.

Line 3 - Installment Due Dates

Determine the amount to enter in column (b) as follows:

Calendar year and fiscal year basis taxpayers are required to

(i) Subtract line 2b from line 2a,

make their Arizona corporate estimated tax payments by the

(ii) Add the result to the amount on line 2a, and

15th day of the 4th, 6th, 9th, and 12th months of the taxable

(iii) Multiply the total in (ii) above by 25 percent.

year. If the installment due date falls on a weekend or legal

Enter 25 percent of line 2a in columns (c) and (d).

holiday, the payment is considered timely if made on the next

business day.

B. If the taxpayer

the annualized income

DOES USE

installment method and/or the adjusted seasonal installment

Note for short period returns: Enter the installment due

method, use the following instructions to determine the

dates and number of installments required by the Internal

amounts to enter on the Form 120W, Schedule A, Part III, line

Revenue Service.

50, columns (a) through (d). Then complete the remainder of

Line 4 - Required Installments

the lines in Part III of Schedule A. Enter the amounts from

Schedule A, Part III, line 54, columns (a) through (d) on

When making estimated tax payments, be sure to take into

Form 120W, line 4, columns (a) through (d).

account any 2010 overpayment that the taxpayer chose to

credit against its 2011 Arizona tax liability.

If Form 120W, line 2a is less than line 2b:

Annualized Income Installment Method and/or Adjusted

Enter 25 percent of line 2a in columns (a) through (d) of

Seasonal Installment Method

Schedule A, Part III, line 50.

If the taxpayer's income is expected to vary during the taxable

If Form 120W, line 2b is less than line 2a:

year because, for example, it operates its business on a seasonal

Enter 25 percent of line 2b in column (a) of Schedule A,

basis, it may be able to lower the amount of one or more

Part III, line 50.

required installments by using the annualized income installment

method or the adjusted seasonal installment method.

Determine the amount to enter in column (b) of Schedule A,

Part III, line 50 as follows:

Use Schedule A to calculate the amount of one or more

(i) Subtract line 2b from line 2a,

required installments using one or both of these methods. If

(ii) Add the result to the amount on line 2a, and

Schedule A is used for any payment due date, it must be used

for all payment due dates.

(iii) Multiply the total in (ii) above by 25 percent.

Enter 25 percent of line 2a in columns (c) and (d) of

Use Schedule A to arrive at the amount of each required

Schedule A, Part III, line 50.

installment and to select the lesser of:

the annualized income installment;

Form 120W, Schedule A

the adjusted seasonal installment (if applicable); or

Follow the steps below to determine which parts of the Form

the regular installment (25% of the required annual

120W, Schedule A, to complete.

payment) increased by any reduction recapture under

If only the annualized income installment method is

IRC § 6655(e)(1)(B).

used, complete Parts I and III of Schedule A.

Instructions for “Large Corporations” (Forms 120 and

If only the adjusted seasonal installment method is used,

120A)

complete Parts II and III of Schedule A.

"Large corporation" means a corporation or unitary group of

If both methods are used, complete all three parts of

corporations if the corporation, or a predecessor corporation,

Schedule A.

had federal taxable income of one million dollars or more for

any of the immediately preceding three taxable years,

All taxpayers: In each column on Form 120W, line 4, enter

excluding any federal net operating loss or capital loss

the amounts from the corresponding column of line 54 of

carrybacks or carryovers. An Arizona affiliated group filing a

Schedule A.

consolidated return pursuant to ARS § 43-947 is treated as a

CAUTION: Do not compute any required installment until after

single corporation for purposes of applying the large

the end of the month preceding the due date for that installment.

corporation definition.

Part I - Annualized Income Installment Method

A. If the taxpayer

the annualized income

DOES NOT USE

installment method or the adjusted seasonal installment

Line 1 - Annualization Periods

method, follow the instructions below to compute the

Enter the annualization period that the taxpayer is using in the

amounts to enter on Form 120W, line 4.

space on line 1, columns (a) through (d), respectively.

If line 2a is less than line 2b:

Enter 25 percent of line 2a in columns (a) through (d) of

line 4.

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4