Form Nrst - Nonresident Sales Tax Rebate 2000 Application

ADVERTISEMENT

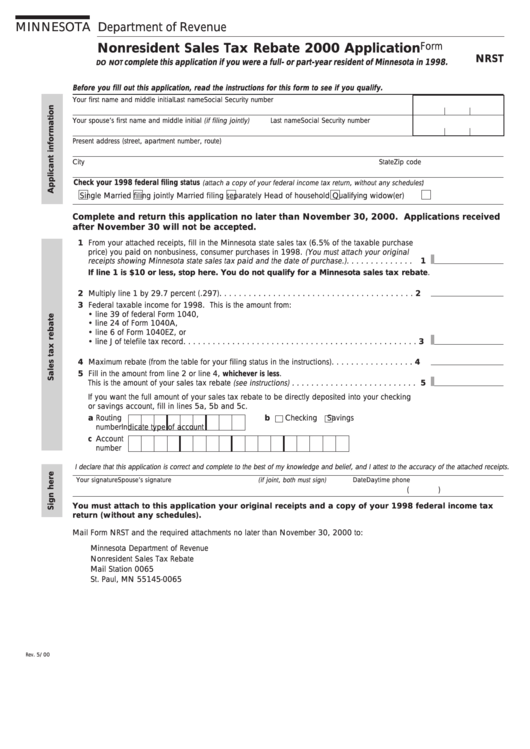

MINNESOTA Department of Revenue

Form

Nonresident Sales Tax Rebate 2000 Application

NRST

complete this application if you were a full- or part-year resident of Minnesota in 1998.

DO NOT

Before you fill out this application, read the instructions for this form to see if you qualify.

Your first name and middle initial

Last name

Social Security number

Your spouse’s first name and middle initial (if filing jointly)

Last name

Social Security number

Present address (street, apartment number, route)

City

State

Zip code

Check your 1998 federal filing status

:

(attach a copy of your federal income tax return, without any schedules)

Single

Married filing jointly

Married filing separately

Head of household

Qualifying widow(er)

Complete and return this application no later than November 30, 2000. Applications received

after November 30 will not be accepted.

1 From your attached receipts, fill in the Minnesota state sales tax (6.5% of the taxable purchase

price) you paid on nonbusiness, consumer purchases in 1998. (You must attach your original

receipts showing Minnesota state sales tax paid and the date of purchase.) . . . . . . . . . . . . . . 1

If line 1 is $10 or less, stop here. You do not qualify for a Minnesota sales tax rebate.

2 Multiply line 1 by 29.7 percent (.297) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Federal taxable income for 1998. This is the amount from:

• line 39 of federal Form 1040,

• line 24 of Form 1040A,

• line 6 of Form 1040EZ, or

• line J of telefile tax record . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Maximum rebate (from the table for your filing status in the instructions) . . . . . . . . . . . . . . . . . 4

5 Fill in the amount from line 2 or line 4, whichever is less.

This is the amount of your sales tax rebate (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . 5

If you want the full amount of your sales tax rebate to be directly deposited into your checking

or savings account, fill in lines 5a, 5b and 5c.

a Routing

b

Checking

Savings

number

Indicate type of account

c Account

number

I declare that this application is correct and complete to the best of my knowledge and belief, and I attest to the accuracy of the attached receipts.

Your signature

Spouse’s signature (if joint, both must sign)

Date

Daytime phone

(

)

You must attach to this application your original receipts and a copy of your 1998 federal income tax

return (without any schedules).

Mail Form NRST and the required attachments no later than November 30, 2000 to:

Minnesota Department of Revenue

Nonresident Sales Tax Rebate

Mail Station 0065

St. Paul, MN 55145-0065

Rev. 5/00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1