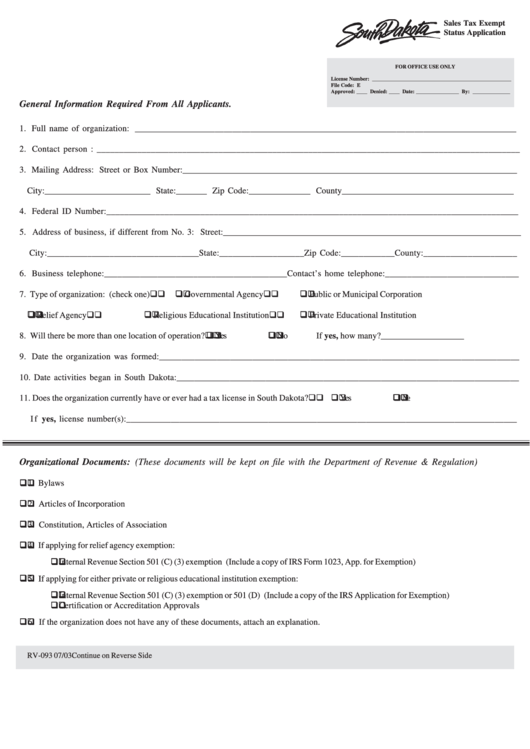

Sales Tax Exempt

Status Application

FOR OFFICE USE ONLY

License Number: ____________________________________________________

File Code: E

Approved: ____ Denied: ____ Date: ________________ By: ______________

General Information Required From All Applicants.

1. Full name of organization: ______________________________________________________________________________________

2. Contact person : ______________________________________________________________________________________________

3. Mailing Address: Street or Box Number:____________________________________________________________________________

City:________________________ State:_______ Zip Code:______________ County_______________________________________

4. Federal ID Number:____________________________________________________________________________________________

5. Address of business, if different from No. 3: Street:____________________________________________________________________

City:__________________________________State:___________________Zip Code:____________County:_____________________

6. Business telephone:_________________________________________Contact’s home telephone:______________________________

! ! ! ! ! Governmental Agency

! ! ! ! ! Public or Municipal Corporation

7. Type of organization: (check one)

! ! ! ! ! Relief Agency

! ! ! ! ! Religious Educational Institution

! ! ! ! ! Private Educational Institution

8. Will there be more than one location of operation? ! ! ! ! ! Yes

! ! ! ! ! No

If yes, how many?___________________

9. Date the organization was formed:_________________________________________________________________________________

10. Date activities began in South Dakota:_____________________________________________________________________________

! ! ! ! ! Yes

! ! ! ! ! No

11. Does the organization currently have or ever had a tax license in South Dakota?

If yes, license number(s):________________________________________________________________________________________

Organizational Documents: (These documents will be kept on file with the Department of Revenue & Regulation)

! ! ! ! ! 1. Bylaws

! ! ! ! ! 2. Articles of Incorporation

! ! ! ! ! 3. Constitution, Articles of Association

! ! ! ! ! 4. If applying for relief agency exemption:

! ! ! ! ! Internal Revenue Section 501 (C) (3) exemption (Include a copy of IRS Form 1023, App. for Exemption)

! ! ! ! ! 5. If applying for either private or religious educational institution exemption:

! ! ! ! ! Internal Revenue Section 501 (C) (3) exemption or 501 (D) (Include a copy of the IRS Application for Exemption)

! ! ! ! ! Certification or Accreditation Approvals

! ! ! ! ! 6. If the organization does not have any of these documents, attach an explanation.

RV-093 07/03

Continue on Reverse Side

1

1 2

2