Form Ab-154 - Common Carrier Alcohol Beverage Tax Return

ADVERTISEMENT

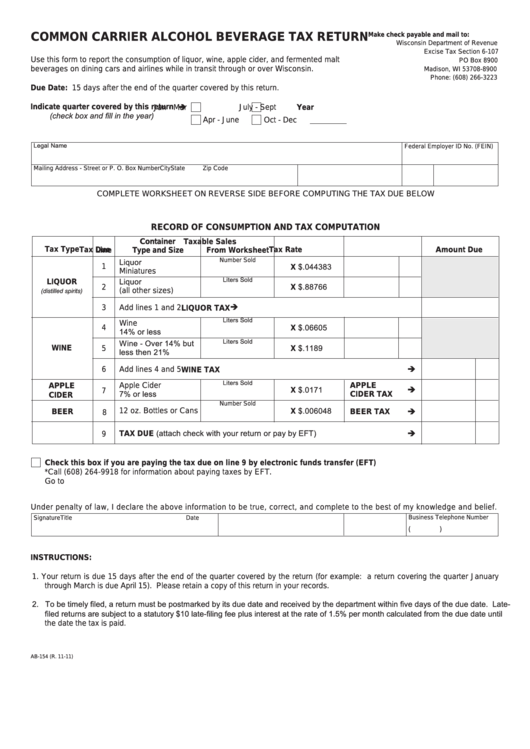

COMMON CARRIER ALCOHOL BEVERAGE TAX RETURN

Make check payable and mail to:

Wisconsin Department of Revenue

Excise Tax Section 6-107

Use this form to report the consumption of liquor, wine, apple cider, and fermented malt

PO Box 8900

beverages on dining cars and airlines while in transit through or over Wisconsin.

Madison, WI 53708-8900

Phone: (608) 266-3223

Due Date: 15 days after the end of the quarter covered by this return.

è

Indicate quarter covered by this return

July - Sept

Year

Jan - Mar

(check box and fill in the year)

Apr - June

Oct - Dec

Legal Name

Federal Employer ID No. (FEIN)

Mailing Address - Street or P. O. Box Number

City

State

Zip Code

COMPLETE WORKSHEET ON REVERSE SIDE BEFORE COMPUTING THE TAX DUE BELOW

RECORD OF CONSUMPTION AND TAX COMPUTATION

Container

Taxable Sales

Tax Type

Tax Rate

Tax Due

Amount Due

Line

Type and Size

From Worksheet

Liquor

Number Sold

1

X $.044383

Miniatures

Liters Sold

Liquor

LIQUOR

2

X $.88766

(distilled spirits)

(all other sizes)

è

3

Add lines 1 and 2

LIQUOR TAX

Liters Sold

Wine

4

X $.06605

14% or less

Liters Sold

Wine - Over 14% but

WINE

5

X $.1189

less then 21%

è

6

Add lines 4 and 5

WINE TAX

Liters Sold

Apple Cider

APPLE

APPLE

è

X $.0171

7

7% or less

CIDER TAX

CIDER

Number Sold

è

12 oz. Bottles or Cans

X $.006048

BEER

BEER TAX

8

è

9

TAX DUE (attach check with your return or pay by EFT)

Check this box if you are paying the tax due on line 9 by electronic funds transfer (EFT)

*Call (608) 264-9918 for information about paying taxes by EFT.

Go to

Under penalty of law, I declare the above information to be true, correct, and complete to the best of my knowledge and belief.

Business Telephone Number

Signature

Title

Date

(

)

INSTRUCTIONS:

1. Your return is due 15 days after the end of the quarter covered by the return (for example: a return covering the quarter January

through March is due April 15). Please retain a copy of this return in your records.

2. To be timely filed, a return must be postmarked by its due date and received by the department within five days of the due date. Late-

filed returns are subject to a statutory $10 late-filing fee plus interest at the rate of 1.5% per month calculated from the due date until

the date the tax is paid.

AB-154 (R. 11-11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2