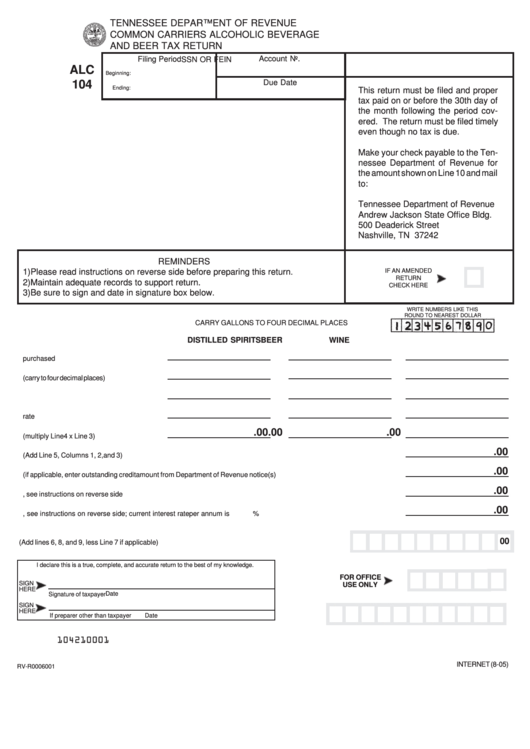

TENNESSEE DEPARTMENT OF REVENUE

COMMON CARRIERS ALCOHOLIC BEVERAGE

AND BEER TAX RETURN

Filing Period

Account No.

SSN OR FEIN

ALC

Beginning:

Due Date

104

Ending:

This return must be filed and proper

tax paid on or before the 30th day of

the month following the period cov-

ered. The return must be filed timely

even though no tax is due.

Make your check payable to the Ten-

nessee Department of Revenue for

the amount shown on Line 10 and mail

to:

Tennessee Department of Revenue

Andrew Jackson State Office Bldg.

500 Deaderick Street

Nashville, TN 37242

REMINDERS

1) Please read instructions on reverse side before preparing this return.

IF AN AMENDED

RETURN

2) Maintain adequate records to support return.

CHECK HERE

3) Be sure to sign and date in signature box below.

WRITE NUMBERS LIKE THIS

ROUND TO NEAREST DOLLAR

CARRY GALLONS TO FOUR DECIMAL PLACES

DISTILLED SPIRITS

BEER

WINE

1. Total gallons purchased ...............................

2. Percentage factor (carry to four decimal places)

3. Taxable gallons ............................................

4. Tax rate ........................................................

.00

.00

.00

5. Tax due (multiply Line 4 x Line 3) .................

.00

6. Total tax due (Add Line 5, Columns 1, 2, and 3) ..................................................................................................................

.00

7. Credit (if applicable, enter outstanding credit amount from Department of Revenue notice(s) ............................................

.00

8. Penalty - if filed late, see instructions on reverse side .........................................................................................................

.00

9. Interest - if filed late, see instructions on reverse side; current interest rate per annum is

% .............................

00

10. Total amount remitted (Add lines 6, 8, and 9, less Line 7 if applicable) ...............................................

I declare this is a true, complete, and accurate return to the best of my knowledge.

FOR OFFICE

SIGN

USE ONLY

HERE

Date

Signature of taxpayer

SIGN

HERE

If preparer other than taxpayer

Date

104210001

INTERNET (8-05)

RV-R0006001

1

1 2

2