Form Bt-100 Instructions And Sample - Wisconsin Brewery Fermented Malt Beverage Tax Return

ADVERTISEMENT

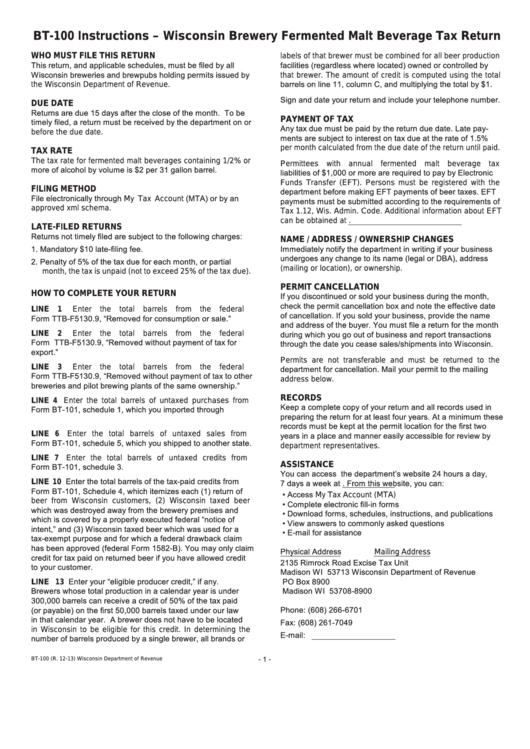

BT-100 Instructions – Wisconsin Brewery Fermented Malt Beverage Tax Return

labels of that brewer must be combined for all beer production

WHO MUST FILE THIS RETURN

This return, and applicable schedules, must be filed by all

facilities (regardless where located) owned or controlled by

Wisconsin breweries and brewpubs holding permits issued by

that brewer. The amount of credit is computed using the total

the Wisconsin Department of Revenue.

barrels on line 11, column C, and multiplying the total by $1.

Sign and date your return and include your telephone number.

DUE DATE

Returns are due 15 days after the close of the month. To be

PAYMENT OF TAX

timely filed, a return must be received by the department on or

Any tax due must be paid by the return due date. Late pay-

before the due date.

ments are subject to interest on tax due at the rate of 1.5%

per month calculated from the due date of the return until paid.

TAX RATE

The tax rate for fermented malt beverages containing 1/2% or

Permittees with annual fermented malt beverage tax

more of alcohol by volume is $2 per 31 gallon barrel.

liabilities of $1,000 or more are required to pay by Electronic

Funds Transfer (EFT). Persons must be registered with the

FILING METHOD

department before making EFT payments of beer taxes. EFT

File electronically through My Tax Account (MTA) or by an

payments must be submitted according to the requirements of

approved xml schema.

Tax 1.12, Wis. Admin. Code. Additional information about EFT

can be obtained at revenue.wi.gov/faqs/pcs/eft.html.

LATE-FILED RETURNS

Returns not timely filed are subject to the following charges:

NAME / ADDRESS / OWNERSHIP CHANGES

Immediately notify the department in writing if your business

1. Mandatory $10 late-filing fee.

undergoes any change to its name (legal or DBA), address

2. Penalty of 5% of the tax due for each month, or partial

(mailing or location), or ownership.

month, the tax is unpaid (not to exceed 25% of the tax due).

PERMIT CANCELLATION

HOW TO COMPLETE YOUR RETURN

If you discontinued or sold your business during the month,

check the permit cancellation box and note the effective date

Enter

the

total

barrels

from

the

federal

LINE

1

of cancellation. If you sold your business, provide the name

Form TTB-F5130.9, “Removed for consumption or sale.”

and address of the buyer. You must file a return for the month

Enter

the

total

barrels

from

the

federal

during which you go out of business and report transactions

LINE

2

Form TTB-F5130.9, “Removed without payment of tax for

through the date you cease sales/shipments into Wisconsin.

export.”

Permits are not transferable and must be returned to the

Enter

the

total

barrels

from

the

federal

LINE

3

department for cancellation. Mail your permit to the mailing

Form TTB-F5130.9, “Removed without payment of tax to other

address below.

breweries and pilot brewing plants of the same ownership.”

RECORDS

LINE 4 Enter the total barrels of untaxed purchases from

Keep a complete copy of your return and all records used in

Form BT-101, schedule 1, which you imported through

preparing the return for at least four years. At a minimum these

U.S. Customs.

records must be kept at the permit location for the first two

Enter the total barrels of untaxed sales from

LINE 6

years in a place and manner easily accessible for review by

Form BT-101, schedule 5, which you shipped to another state.

department representatives.

Enter the total barrels of untaxed credits from

LINE 7

ASSISTANCE

Form BT-101, schedule 3.

You can access the department’s website 24 hours a day,

LINE 10 Enter the total barrels of the tax-paid credits from

7 days a week at revenue.wi.gov. From this website, you can:

Form BT-101, Schedule 4, which itemizes each (1) return of

• Access My Tax Account (MTA)

beer from Wisconsin customers, (2) Wisconsin taxed beer

• Complete electronic fill-in forms

which was destroyed away from the brewery premises and

• Download forms, schedules, instructions, and publications

which is covered by a properly executed federal “notice of

• View answers to commonly asked questions

intent,” and (3) Wisconsin taxed beer which was used for a

• E-mail for assistance

tax-exempt purpose and for which a federal drawback claim

has been approved (federal Form 1582-B). You may only claim

Physical Address

Mailing Address

credit for tax paid on returned beer if you have allowed credit

2135 Rimrock Road

Excise Tax Unit

to your customer.

Madison WI 53713

Wisconsin Department of Revenue

Enter your “eligible producer credit,” if any.

PO Box 8900

LINE 13

Brewers whose total production in a calendar year is under

Madison WI 53708-8900

300,000 barrels can receive a credit of 50% of the tax paid

Phone: (608) 266-6701

(or payable) on the first 50,000 barrels taxed under our law

in that calendar year. A brewer does not have to be located

Fax:

(608) 261-7049

in Wisconsin to be eligible for this credit. In determining the

E-mail: excise@revenue.wi.gov

number of barrels produced by a single brewer, all brands or

- 1 -

BT-100 (R. 12-13)

Wisconsin Department of Revenue

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2