Form Dr-309635 Sample - Blender Fuel Tax Return - 2015 Page 4

ADVERTISEMENT

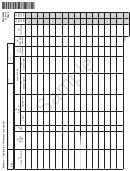

DR-309635

R. 01/14

Page 4

Company Name

FEIN

Collection Period Ending

GALLONS

DIESEL

A. Gasoline

B. Undyed

C. Dyed

D. Aviation

1.

Beginning physical inventory: (must agree with

prior month’s ending inventory) .....................

2.

Receipts: (Line 3, Section I, Page 5) ..............

3.

Disbursements:

(Line 4, Section II, Page 5) ..............................

4.

Transfers: ........................................................

5.

Gain or (Loss): .................................................

6.

Ending physical inventory: .............................

7.

Net taxable gallons: (Line 1, Section I, Page 5,

Column A - Gasoline, Column B - Diesel, and

Column D - Aviation) .......................................

State Tax Calculations

DOLLARS

8.

Gasoline: (Line 7, Column A times

00 00

),

.28525

and Diesel: (Line 7, Column B times

0000

) ..

.173

9.

Aviation: (Line 7, Column D times

0000

) .......

.069

10. Collection allowance -

Gasoline: (Line 8, Column A times

000 0

)

.00314

Aviation: (Line 9, Column D times

) ...

.002

11. Collection Allowance -

Diesel: (Line 8, Column B times

000000

) ......

.0067

12. Net state fuel tax due: ....................................

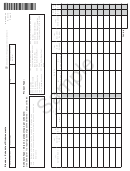

Local Option Tax Collection Allowance

DIESEL

Calculations – Gasoline

A. Gasoline

B. Undyed

C. Dyed

D. Aviation

13. Local option tax entitled to collection

allowance - Gasoline: (Schedule 11, Column C

........................................

14. Collection allowance - gasoline local option

tax: (Line 13, Column A times

0000

) .............

.011

15. Local option tax not entitled to collection

allowance - Gasoline: (Schedule 11, Column E

........................................

16. Total local option tax due - Gasoline: (Line 13

minus Line 14 plus Line 15) ............................

Local Option Tax Collection Allowance

Calculations – Diesel

17. Local option tax entitled to collection allowance

- Diesel: (Line 7, Column B times

000

) ...........

.07

18. Collection allowance - diesel local option tax:

(Line 17, Column B times

0000

) .....................

.011

19. Local option tax not entitled to collection

allowance - Diesel: (Line 7, Column B

times

0000

) ....................................................

.073

20. Total local option tax due - Diesel: (Line 17

minus Line 18 plus Line 19) ............................

Total State and Local Option Tax Due

Calculations

21. Total tax due - Gasoline: (Line 12, Column A

plus Line 16, Column A) ..................................

22. Total tax due - Diesel: (Line 12, Column B plus

Line 20, Column B) .........................................

23. Total tax due - Aviation:

(Line 12, Column D) .........................................

24. Combined gasoline, diesel, aviation, and local option fuel tax due: (Add Lines 21, 22, and 23. Carry to Page 3, Line 24.) ......

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14