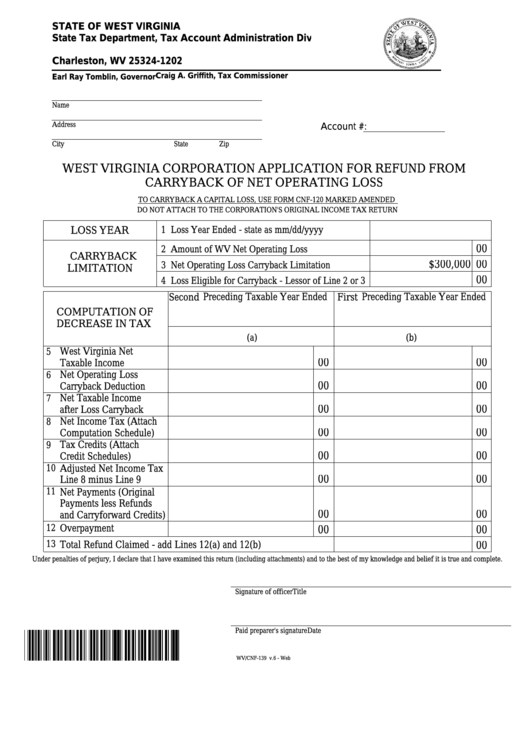

Form Wv/cnf-139 - West Virginia Corporation Application For Refund From Carryback Of Net Operating Loss

ADVERTISEMENT

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 1202

Charleston, WV 25324-1202

Craig A. Griffith, Tax Commissioner

Earl Ray Tomblin, Governor

Name

Address

Account #:

City

State

Zip

WEST VIRGINIA CORPORATION APPLICATION FOR REFUND FROM

CARRYBACK OF NET OPERATING LOSS

TO CARRYBACK A CAPITAL LOSS, USE FORM CNF-120 MARKED AMENDED

DO NOT ATTACH TO THE CORPORATION'S ORIGINAL INCOME TAX RETURN

LOSS YEAR

1 Loss Year Ended - state as mm/dd/yyyy

00

2 Amount of WV Net Operating Loss

CARRYBACK

$300,000

00

3 Net Operating Loss Carryback Limitation

LIMITATION

00

4 Loss Eligible for Carryback - Lessor of Line 2 or 3

Second Preceding Taxable Year Ended

First Preceding Taxable Year Ended

COMPUTATION OF

DECREASE IN TAX

(a)

(b)

5

West Virginia Net

00

00

Taxable Income

6

Net Operating Loss

00

00

Carryback Deduction

7

Net Taxable Income

00

00

after Loss Carryback

8

Net Income Tax (Attach

00

00

Computation Schedule)

9

Tax Credits (Attach

00

00

Credit Schedules)

10

Adjusted Net Income Tax

00

00

Line 8 minus Line 9

11

Net Payments (Original

Payments less Refunds

00

00

and Carryforward Credits)

12

Overpayment

00

00

13

Total Refund Claimed - add Lines 12(a) and 12(b)............................

00

Under penalties of perjury, I declare that I have examined this return (including attachments) and to the best of my knowledge and belief it is true and complete.

Signature of officer

Title

Paid preparer's signature

Date

WV/CNF-139 v.6 - Web

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2