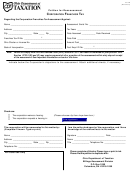

Instructions for Completing Petition for Reassessment

Rev. 10/14

This is a generic form that may be used to file a Petition for

C. In Order to Request That the “Corrected Assessment”

Reassessment for any tax. For purposes of these instructions,

Procedure NOT Be Used CHECK THE BOX

all assessment notices are covered by the term “assessment,”

If this box is checked, a fi nal determination will be issued and the

regardless of their technical title.

streamlined procedure will not be used.

IMPORTANT: Because different taxes have different fi ling deadlines,

D. Select a Box (If a corrected assessment is issued, THERE WILL

you may safely fi le this form NO LATER THAN 60 DAYS from the

date found on the assessment and you will be timely regardless

BE NO HEARING, even if you requested one.)

No hearing: All of your information will be carefully reviewed and

of the type of tax assessed.

Laws relating to particular types of assessments are located in Title

considered, but you will not have to participate in a hearing.

Hearing by telephone: This is an informal discussion to gather facts

57 of the Ohio Revised Code. You are responsible for complying with

and listen to the taxpayer’s (or representative’s) legal arguments.

all of the requirements of the law. (The on-line link to the Revised

Code is available at tax.ohio.gov. Go to the “Tax Professionals”

You may submit information. Please number your pages and retain a

duplicate for yourself so that specifi c documentation can be reviewed

tab, then to the heading “Laws/Rules/Rulings.”)

and discussed during the hearing. You may use a conference call to

Section-by-Section Instructions

include your representative or anyone else you choose.

Personal appearance hearing: This is an informal face-to-face

A. General Information

Most of the information that you need to complete this section can

meeting centered on gathering facts and listening to the taxpayer’s

be found on the assessment. Please use it as a reference.

(or representative’s) legal arguments. This is also the taxpayer’s

Daytime phone: Please provide the number where you can be

opportunity to present any documentation for review and discussion.

reached during business hours.

E-mail address: Providing your e-mail address will allow us to

E. Petition in Response to a “Corrected Assessment”

If you have already received a “corrected assessment” and you are

communicate with you effi ciently and discreetly.

Assessment serial number: This number is listed on the

fi ling this petition because you disagree with the adjusted amount

assessment. It is not applicable for personal property, dealer

on the “corrected assessment,” CHECK THE BOX.

intangibles or public utility tax assessments.

Date of assessment: The date found on the assessment

F. Basis for Filing this Petition for Reassessment

Please list all of the reasons that you think the Ohio Department

document.

Tax period(s): List the periods or the tax year(s) assessed.

of Taxation erred when it issued the assessment or the corrected

Disputed amount: The portion of the assessment that you are

assessment. You must be specifi c with your objections. However,

you are free to present your case in the manner of your choice.

protesting. Usually, this amount does not need to be paid before

You may make legal arguments. You may cite specifi c sections of

this petition is fi led. However, there are exceptions. For example,

the Ohio Revised Code or the Ohio Administrative Code. You may

when only the penalty or interest is being protested in the corporate

franchise tax or personal income tax, payment of tax and interest

reference and attach specifi c court or Board of Tax Appeals cases.

You may attach photographs or include any other documentation.

(but not penalty) is required.

Federal employee I.D. number (FEIN): An I.D. number assigned

You are not limited. You may attach additional pages, but please

CHECK THE BOX and list the total.

for business purposes. It is not required for personal income tax

matters.

Social security number: The social security number of your spouse

G. Person Responsible for Filing this Petition

Name/title: This is the individual vouching for the accuracy of the

is requested if the assessment involves a joint income tax return.

information presented. This person should be familiar with all of the

facts and issues related to this matter. This may be the individual

B. Corrected Assessment is NOT available for property and public

utility assessments (except in R.C. 5727.26 and R.C. 5727.89).

petitioner, an employee or owner of the business, or the person

What is a “corrected assessment”? According to R.C. 5703.60,

designated as the representative. Whoever is responsible for fi ling

when a petition for reassessment has been properly fi led, the Tax

this request must provide their signature, name, title, date and phone

number.

Commissioner may respond by issuing a “corrected assessment.”

This is a more streamlined response to the petition than a fi nal

H. Contact Person (Information required ONLY if different from the

determination and it may both simplify and expedite resolution of the

“Person Responsible for Filing this Petition.”)

matter. The Notice of Corrected Assessment does not contain the

This may be the individual petitioner, an employee or owner of the

legal analysis of the tax commissioner. Only a fi nal determination

business, or a separate person chosen to be the representative. A

(not a corrected assessment) can be appealed to the Board of Tax

representative does not need to be an attorney or an accountant,

Appeals or Ohio courts.

What if the taxpayer disagrees with the “corrected assessment”?

but the petitioner must authorize them.

If the contact person is the taxpayer’s representative, the taxpayer

If a corrected assessment is issued and the taxpayer disagrees with

needs to complete form TBOR 1 and return it along with this petition.

the result, the taxpayer still has the option of fi ling a new petition

Form TBOR 1 authorizes the contact person to represent the claimant

for reassessment protesting the “corrected assessment.” This same

and allows the Ohio Department of Taxation to talk to this person. (An

form is used to fi le a petition in response to a corrected assessment.

on-line link is available at tax.ohio.gov. Go to the “Tax Professionals”

In response to this new petition, the Tax Commissioner will issue

tab, then to the heading “Taxpayer Representation.”)

a fi nal determination. Only one corrected assessment may be

issued.

What if the taxpayer fails to fi le a new petition for reassessment

I. Mail This Form To:

Different taxes must be mailed to different addresses. If in doubt use

after receiving a “corrected assessment”? According to R.C.

the address provided for “all other taxes.”

5703.60, the issuance of a corrected assessment nullifi es the original

The petition may be hand delivered to:

petition for reassessment and the original petition is not subject to

– 4485 Northland Ridge Blvd., Columbus, OH 43229

further administrative review or appeal. Therefore, the corrected

– 30 East Broad St., 23rd Floor, Columbus, OH 43216

assessment becomes fi nal.

1

1 2

2