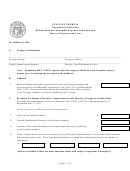

D.

Exception for Expenses Paid, Accrued, or Incurred to a Related Member Domiciled in a Foreign

Nation. (For additional information, please see subsection (e) of Code § 48-7-28.3 and paragraph (6)

of Regulation 560-7-3-.05).

Attach a separate schedule for each related member.

1.

Name of the related member.

1.

2.

Federal Identification Number of the related member.

2.

3.

Country of domicile of the related member.

3.

4.

Provide a description of the comprehensive income tax treaty:

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

5.

Provide a description of the business purpose of the transactions between the taxpayer and the related

member. Please see subparagraph (6)(b)5. of Regulation 560-7-3-.05 for the specific information that

should be included:

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

6.

Provide a brief description of the arm’s length status of the transactions between the taxpayer and the

related member. Please see subparagraph (5)(d)5. of Regulation 560-7-3-.05 for specific information

that should be included:

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

7.

Amount of the related member costs paid to such related member.

7.

(Amount eligible for this exception).

Page 3 of 4

1

1 2

2 3

3 4

4