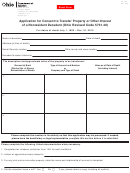

ET 12

Rev. 9/07

Page 3

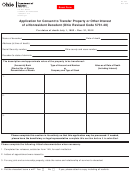

In the case of commercial accounts, the fiduciary should present the bookkeeping statement of the bank showing the balance

on date of death less honored checks drawn by decedent prior to death. In the case of P.O.D. accounts, when the passbook fails

to disclose the name of the beneficiary, a letter from the bank should accompany the passbook giving this date.

B. Stocks/bonds – provide the following:

1.

Total number of shares or denomination of bonds

2.

Rate of interest and due date

3.

Type and the manner in which they are registered, if registered other than solely in name of decedent

It shall be assumed that all stocks are common unless otherwise indicated.

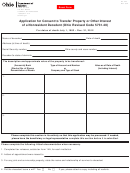

General Information

File this form with the county auditor together with completed tax release(s) (estate tax form 14).

Ohio Revised Code (R.C.) section 5731.39 provides a penalty

liability on any property transferred will be determined by the

of the amount of the tax and up to $5,000 if a corporation,

tax commissioner upon audit of the estate tax return. An es-

safe-deposit box company, bank, savings and loan associa-

tate tax return may be required to be filed pursuant to R.C.

tion, trust company or similar institution transfers more than a

section 5731.21. Failure to timely file may subject the tax-

three-fourths interest in property belonging to or standing in

payer to a penalty pursuant to R.C. section 5731.22.

the name or joint name of a decedent or in trust for a decedent

The tax release estate tax form 14 must accompany this form

without obtaining a consent to transfer from the tax commis-

to obtain a release. Since the tax release, estate tax form 14,

sioner. It is necessary for such institutions to request a con-

will reflect only the last entry balance posted prior to death,

sent to transfer for the entire amount of any such interest prior

this entry may or may not reflect the entire date of death value

to final transfer from the decedent’s name. The county auditor

with the accrued interest due.

is the tax commissioner’s agent for these purposes.

The fact that a consent to transfer is issued does not in itself

establish tax liability nor does it relieve from tax liability. Tax

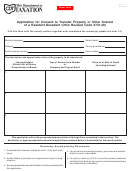

1

1 2

2 3

3 4

4