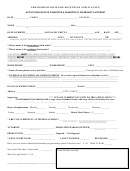

Pre-Authorized Debit Plan Terms & Conditions

Please retain a copy for your records

instruct the Village to discontinue the Pre-Authorized Debit BEFORE

1.

It is the responsibility of the property owner to

the property is sold.

This is important since we will continue to draw payments from your bank account until

advised in writing. Any overpayment will be applied to the credit of the new owner. Credits must be adjusted

between vendors and purchasers on the Statement of Adjustments. No refunds will be issued as a result of failure to

cancel the plan upon transfer of the property.

2.

In the event the taxpayer’s mortgage company is to pay property taxes, it is the tax payer’s responsibility to submit a

written request to stop pre-authorized debits 10 days prior to the installment date.

3.

Your Pre-Authorized Debit Plan may be changed or cancelled any time provided written notice is received by the

Village of Anmore 10 days prior to the next scheduled withdrawal.

4.

All current & prior TAXES and UTILITIES must be paid in full prior to enrolling in the plan. Payments in

subsequent billings will be applied to any outstanding balance first as required.

5.

PAYMENTS will be collected on the 15th day of each month from August to May. There are no withdrawals in June or

July.

6.

Your annual PROPERTY TAX NOTICE (mailed in May) will indicate total taxes levied, less amount prepaid including any

interest earned, and the balance owing (or any overpayment on your account which will remain as a credit for the next

year’s tax notice).

7.

Your bi-annual UTILITY INVOICES (mailed in April and October) will indicate total utility charges for the billing period

less amount prepaid to invoice date including any interest earned, and the balance owing (or any overpayment on your

account which will remain as a credit for the next invoice).

8.

DISHONOURED PAYMENTS are subject to the current NSF fee as per the Fees and Charges Bylaw. This fee may be

increased in the future without notice. Your Pre-Authorized Debit Plan may be terminated after two dishonoured

Electronic Transfers within one year. The Village may not provide notice of non-payment or cancellation.

9.

Interest will be earned at the prime lending rate of the Village’s principal banker, in effect on the last day of the previous

month, less 3%.

10. You may ENROLL in the Pre-Authorized Debit Plan at any time during the year.

11. It is your responsibility to make appropriate changes to the withdrawal amount in subsequent years. Overpayments

will not be refunded and will remain on the tax &/or utility account(s) as a credit to be applied against future

billings.

12. For new applicants and change of banking information, A VOID PERSONALIZED CHEQUE must be attached to this

application and returned to the Village of Anmore 10 days prior to your start date.

13. The Village of Anmore Pre-Authorized Debit Plan is in accordance with Bylaw No. 562-2017

If eligible, the HOME OWNER GRANT must continue to be claimed by the owner each year. TO AVOID PENALTIES,

CLAIM THE GRANT AND PAY ANY OUTSTANDING BALANCE NOTED ON YOUR TAX &/OR UTILITY NOTICES PRIOR

TO DUE DATES.

The following calculations are provided for your convenience and are an estimate only; they are not a warranty or guarantee

of the amount of taxes &/or utilities which may be levied. Tax payers may wish to add a percentage (%) increase to their

prepayment amount to account for potential increases to property tax and utility rates in future years.

ESTIMATION OF THE PROPERTY TAX PREPAYMENT AMOUNT

ESTIMATION OF THE UTILITIES PREPAYMENT AMOUNT

1.

Property taxes for current year

(A)

1. Utility charges on last two billings

(A)

2.

Subtract Home Owner Grant, if applicable:

(B)

Basic Grant (under 65)

-$570

2. Subtract Credit on Account (overpayment),

Basic and Additional Grant

-$845

(B)

if any:

(C)

3.

Subtract Credit on Account (overpayment),

2. Total Utility Charges over the year (A)+(B)–(C )

(D)

if any:

(C)

3. Divide (D) by 10 or provide other amount you

3.

Total Prepayment Amount (A)-(B-(C)

(D)

wish to pay

(E)

4.

Divide (D) by number of months remaining to May 1

or provide other amount you wish to pay

(E)

Be sure to enter the amount you would like withdrawn from

Be sure to enter the amount you would like withdrawn from

your bank account on the opposite side of this form (in Part 2)

your bank account on the opposite side of this form (in Part 2).

.

Freedom of Information and Protection of Privacy Act

The personal information collected on this form is collected in accordance with the

.

Pre-Authorized

The Village has authority to collect your information for the purposes of administering the Village of Anmore Property Tax

Debit Plan

Bylaw No. 562-2017. Should you have any questions or concerns about the collection of your personal information please call

the Village at 604-469-9877.

Page 2

1

1 2

2