This form is available electronically.

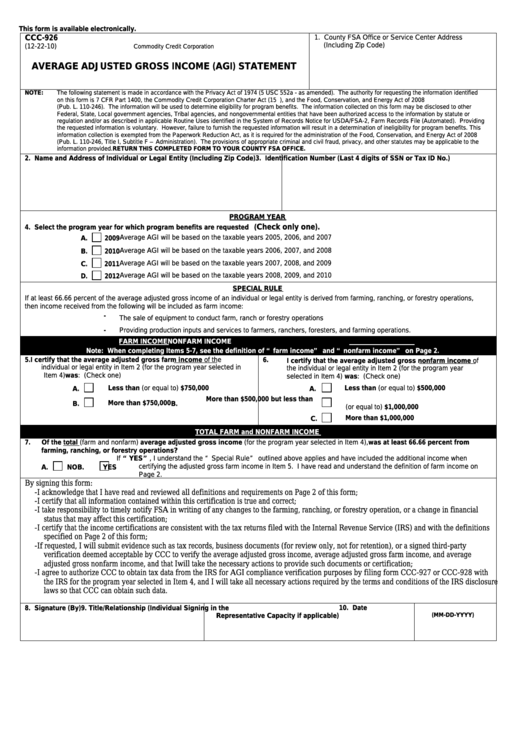

CCC-926

1. County FSA Office or Service Center Address

U.S. DEPARTMENT OF AGRICULTURE

(Including Zip Code)

(12-22-10)

Commodity Credit Corporation

AVERAGE ADJUSTED GROSS INCOME (AGI) STATEMENT

NOTE:

The following statement is made in accordance with the Privacy Act of 1974 (5 USC 552a - as amended). The authority for requesting the information identified

on this form is 7 CFR Part 1400, the Commodity Credit Corporation Charter Act (15 U.S.C. 714 et seq.), and the Food, Conservation, and Energy Act of 2008

(Pub. L. 110-246). The information will be used to determine eligibility for program benefits. The information collected on this form may be disclosed to other

Federal, State, Local government agencies, Tribal agencies, and nongovernmental entities that have been authorized access to the information by statute or

regulation and/or as described in applicable Routine Uses identified in the System of Records Notice for USDA/FSA-2, Farm Records File (Automated). Providing

the requested information is voluntary. However, failure to furnish the requested information will result in a determination of ineligibility for program benefits. This

information collection is exempted from the Paperwork Reduction Act, as it is required for the administration of the Food, Conservation, and Energy Act of 2008

(Pub. L. 110-246, Title I, Subtitle F –Administration). The provisions of appropriate criminal and civil fraud, privacy, and other statutes may be applicable to the

information provided. RETURN THIS COMPLETED FORM TO YOUR COUNTY FSA OFFICE.

2. Name and Address of Individual or Legal Entity (Including Zip Code)

3. Identification Number (Last 4 digits of SSN or Tax ID No.)

PROGRAM YEAR

(Check only one).

4. Select the program year for which program benefits are requested

Average AGI will be based on the taxable years 2005, 2006, and 2007

A.

2009

Average AGI will be based on the taxable years 2006, 2007, and 2008

B.

2010

Average AGI will be based on the taxable years 2007, 2008, and 2009

C.

2011

Average AGI will be based on the taxable years 2008, 2009, and 2010

D.

2012

SPECIAL RULE

If at least 66.66 percent of the average adjusted gross income of an individual or legal entity is derived from farming, ranching, or forestry operations,

then income received from the following will be included as farm income:

-

The sale of equipment to conduct farm, ranch or forestry operations

-

Providing production inputs and services to farmers, ranchers, foresters, and farming operations.

FARM INCOME

NONFARM INCOME

Note: When completing Items 5-7, see the definition of “ farm income” and “ nonfarm income” on Page 2.

5.

I certify that the average adjusted gross farm income of the

6.

I certify that the average adjusted gross nonfarm income of

individual or legal entity in Item 2 (for the program year selected in

the individual or legal entity in Item 2 (for the program year

Item 4) was: (Check one)

selected in Item 4) was: (Check one)

Less than (or equal to) $750,000

Less than (or equal to) $500,000

A.

A.

More than $500,000 but less than

More than $750,000

B.

B.

(or equal to) $1,000,000

More than $1,000,000

C.

TOTAL FARM and NONFARM INCOME

7.

Of the total (farm and nonfarm) average adjusted gross income (for the program year selected in Item 4), was at least 66.66 percent from

farming, ranching, or forestry operations?

If “ YES” , I understand the “ Special Rule” outlined above applies and have included the additional income when

certifying the adjusted gross farm income in Item 5. I have read and understand the definition of farm income on

A.

NO

B.

YES

Page 2.

By signing this form:

- I acknowledge that I have read and reviewed all definitions and requirements on Page 2 of this form;

- I certify that all information contained within this certification is true and correct;

- I take responsibility to timely notify FSA in writing of any changes to the farming, ranching, or forestry operation, or a change in financial

status that may affect this certification;

- I certify that the income certifications are consistent with the tax returns filed with the Internal Revenue Service (IRS) and with the definitions

specified on Page 2 of this form;

- If requested, I will submit evidence such as tax records, business documents (for review only, not for retention), or a signed third-party

verification deemed acceptable by CCC to verify the average adjusted gross income, average adjusted gross farm income, and average

adjusted gross nonfarm income, and that I will take the necessary actions to provide such documents or certification;

- I agree to authorize CCC to obtain tax data from the IRS for AGI compliance verification purposes by filing form CCC-927 or CCC-928 with

the IRS for the program year selected in Item 4, and I will take all necessary actions required by the terms and conditions of the IRS disclosure

laws so that CCC can obtain such data.

8. Signature (By)

9. Title/Relationship (Individual Signing in the

10. Date

(MM-DD-YYYY)

Representative Capacity if applicable)

1

1 2

2