Print

Clear

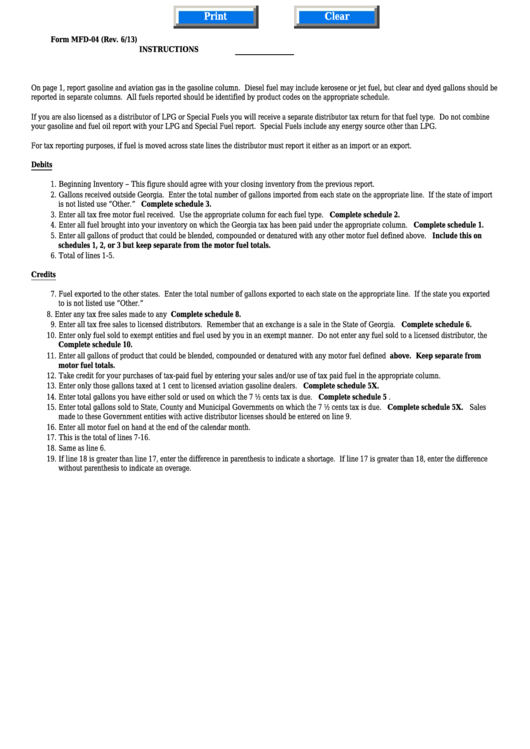

Form MFD-04 (Rev. 6/13)

INSTRUCTIONS

On page 1, report gasoline and aviation gas in the gasoline column. Diesel fuel may include kerosene or jet fuel, but clear and dyed gallons should be

reported in separate columns. All fuels reported should be identified by product codes on the appropriate schedule.

If you are also licensed as a distributor of LPG or Special Fuels you will receive a separate distributor tax return for that fuel type. Do not combine

your gasoline and fuel oil report with your LPG and Special Fuel report. Special Fuels include any energy source other than LPG.

For tax reporting purposes, if fuel is moved across state lines the distributor must report it either as an import or an export.

Debits

1. Beginning Inventory – This figure should agree with your closing inventory from the previous report.

2. Gallons received outside Georgia. Enter the total number of gallons imported from each state on the appropriate line. If the state of import

is not listed use “Other.” Complete schedule 3.

3. Enter all tax free motor fuel received. Use the appropriate column for each fuel type. Complete schedule 2.

4. Enter all fuel brought into your inventory on which the Georgia tax has been paid under the appropriate column. Complete schedule 1.

5. Enter all gallons of product that could be blended, compounded or denatured with any other motor fuel defined above. Include this on

schedules 1, 2, or 3 but keep separate from the motor fuel totals.

6. Total of lines 1-5.

Credits

7. Fuel exported to the other states. Enter the total number of gallons exported to each state on the appropriate line. If the state you exported

to is not listed use “Other.”

8. Enter any tax free sales made to any U.S. Government entity. Complete schedule 8.

9. Enter all tax free sales to licensed distributors. Remember that an exchange is a sale in the State of Georgia. Complete schedule 6.

10. Enter only fuel sold to exempt entities and fuel used by you in an exempt manner. Do not enter any fuel sold to a licensed distributor, the

U.S. Government or transfers to other states on this line. Complete schedule 10.

11. Enter all gallons of product that could be blended, compounded or denatured with any motor fuel defined above. Keep separate from

motor fuel totals.

12. Take credit for your purchases of tax-paid fuel by entering your sales and/or use of tax paid fuel in the appropriate column.

13. Enter only those gallons taxed at 1 cent to licensed aviation gasoline dealers. Complete schedule 5X.

14. Enter total gallons you have either sold or used on which the 7 ½ cents tax is due. Complete schedule 5 .

15. Enter total gallons sold to State, County and Municipal Governments on which the 7 ½ cents tax is due. Complete schedule 5X. Sales

made to these Government entities with active distributor licenses should be entered on line 9.

16. Enter all motor fuel on hand at the end of the calendar month.

17. This is the total of lines 7-16.

18. Same as line 6.

19. If line 18 is greater than line 17, enter the difference in parenthesis to indicate a shortage. If line 17 is greater than 18, enter the difference

without parenthesis to indicate an overage.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9