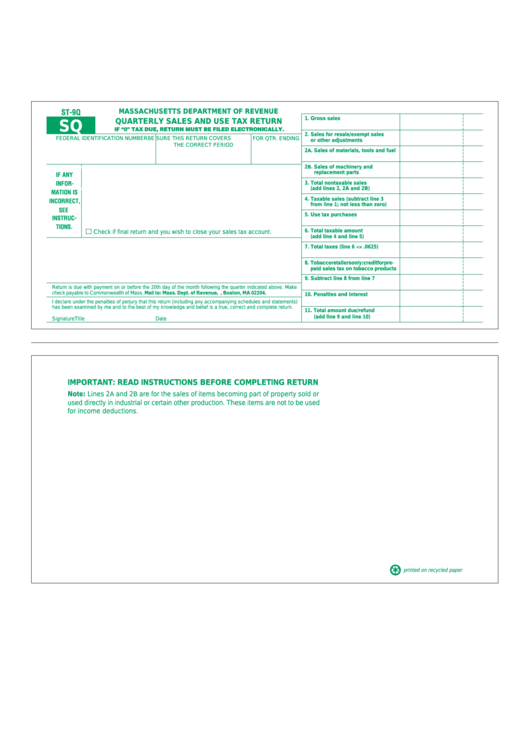

ST-9Q

MASSACHUSETTS DEPARTMENT OF REVENUE

1. Gross sales

QUARTERLY SALES AND USE TAX RETURN

SQ

IF “0” TAX DUE, RETURN MUST BE FILED ELECTRONICALLY.

2. Sales for resale/exempt sales

FEDERAL IDENTIFICATION NUMBER

BE SURE THIS RETURN COVERS

FOR QTR. ENDING

or other adjustments

THE CORRECT PERIOD

2

A

. Sales of materials, tools and fuel

2

B

. Sales of machinery and

BUSINESS NAME

replacement parts

IF ANY

3. Total nontaxable sales

INFOR-

(add lines 2, 2A and 2B)

BUSINESS ADDRESS

MATION IS

4. Taxable sales (subtract line 3

INCORRECT,

from line 1; not less than zero)

SEE

CITY/TOWN

STATE

ZIP

5. Use tax purchases

INSTRUC-

TIONS.

6. Total taxable amount

Check if final return and you wish to close your sales tax account.

(add line 4 and line 5)

7. Total taxes (line 6 × × .0625)

8. Tobacco retailers only: credit for pre-

paid sales tax on tobacco products

9. Subtract line 8 from line 7

Return is due with payment on or before the 20th day of the month following the quarter indicated above. Make

check payable to Commonwealth of Mass. Mail to: Mass. Dept. of Revenue, P.O. Box 7043, Boston, MA 02204.

10. Penalties and interest

I declare under the penalties of perjury that this return (including any accompanying schedules and statements)

has been examined by me and to the best of my knowledge and belief is a true, correct and complete return.

11. Total amount due/refund

(add line 9 and line 10)

Signature

Title

Date

IMPORTANT: READ INSTRUCTIONS BEFORE COMPLETING RETURN

Note: Lines 2

and 2

are for the sales of items becoming part of property sold or

A

B

used directly in industrial or certain other production. These items are not to be used

for income deductions.

printed on recycled paper

1

1