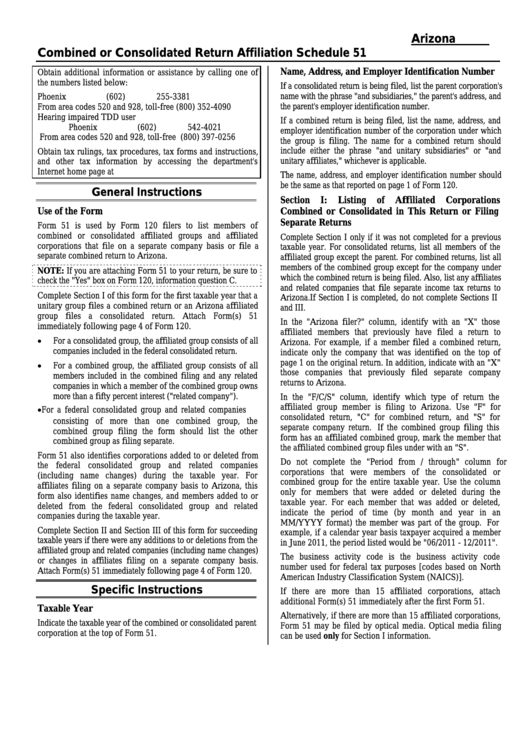

Instructions For Arizona Form 51 - Combined Or Consolidated Return Affiliation Schedule

ADVERTISEMENT

Arizona Form

Combined or Consolidated Return Affiliation Schedule

51

Name, Address, and Employer Identification Number

Obtain additional information or assistance by calling one of

the numbers listed below:

If a consolidated return is being filed, list the parent corporation's

name with the phrase "and subsidiaries," the parent's address, and

Phoenix

(602) 255-3381

the parent's employer identification number.

From area codes 520 and 928, toll-free

(800) 352-4090

Hearing impaired TDD user

If a combined return is being filed, list the name, address, and

Phoenix

(602) 542-4021

employer identification number of the corporation under which

From area codes 520 and 928, toll-free

(800) 397-0256

the group is filing. The name for a combined return should

include either the phrase "and unitary subsidiaries" or "and

Obtain tax rulings, tax procedures, tax forms and instructions,

unitary affiliates," whichever is applicable.

and other tax information by accessing the department's

Internet home page at

The name, address, and employer identification number should

be the same as that reported on page 1 of Form 120.

General Instructions

Section

I:

Listing

of

Affiliated

Corporations

Use of the Form

Combined or Consolidated in This Return or Filing

Separate Returns

Form 51 is used by Form 120 filers to list members of

combined or consolidated affiliated groups and affiliated

Complete Section I only if it was not completed for a previous

corporations that file on a separate company basis or file a

taxable year. For consolidated returns, list all members of the

separate combined return to Arizona.

affiliated group except the parent. For combined returns, list all

members of the combined group except for the company under

NOTE: If you are attaching Form 51 to your return, be sure to

which the combined return is being filed. Also, list any affiliates

check the "Yes" box on Form 120, information question C.

and related companies that file separate income tax returns to

Complete Section I of this form for the first taxable year that a

Arizona. If Section I is completed, do not complete Sections II

unitary group files a combined return or an Arizona affiliated

and III.

group files a consolidated return. Attach Form(s) 51

In the "Arizona filer?" column, identify with an "X" those

immediately following page 4 of Form 120.

affiliated members that previously have filed a return to

For a consolidated group, the affiliated group consists of all

Arizona. For example, if a member filed a combined return,

companies included in the federal consolidated return.

indicate only the company that was identified on the top of

page 1 on the original return. In addition, indicate with an "X"

For a combined group, the affiliated group consists of all

those companies that previously filed separate company

members included in the combined filing and any related

returns to Arizona.

companies in which a member of the combined group owns

more than a fifty percent interest ("related company").

In the "F/C/S" column, identify which type of return the

affiliated group member is filing to Arizona. Use "F" for

For a federal consolidated group and related companies

consolidated return, "C" for combined return, and "S" for

consisting of more than one combined group, the

separate company return. If the combined group filing this

combined group filing the form should list the other

form has an affiliated combined group, mark the member that

combined group as filing separate.

the affiliated combined group files under with an "S".

Form 51 also identifies corporations added to or deleted from

Do not complete the "Period from / through" column for

the federal consolidated group and related companies

corporations that were members of the consolidated or

(including name changes) during the taxable year. For

combined group for the entire taxable year. Use the column

affiliates filing on a separate company basis to Arizona, this

only for members that were added or deleted during the

form also identifies name changes, and members added to or

taxable year. For each member that was added or deleted,

deleted from the federal consolidated group and related

indicate the period of time (by month and year in an

companies during the taxable year.

MM/YYYY format) the member was part of the group. For

Complete Section II and Section III of this form for succeeding

example, if a calendar year basis taxpayer acquired a member

taxable years if there were any additions to or deletions from the

in June 2011, the period listed would be "06/2011 - 12/2011".

affiliated group and related companies (including name changes)

The business activity code is the business activity code

or changes in affiliates filing on a separate company basis.

number used for federal tax purposes [codes based on North

Attach Form(s) 51 immediately following page 4 of Form 120.

American Industry Classification System (NAICS)].

Specific Instructions

If there are more than 15 affiliated corporations, attach

additional Form(s) 51 immediately after the first Form 51.

Taxable Year

Alternatively, if there are more than 15 affiliated corporations,

Indicate the taxable year of the combined or consolidated parent

Form 51 may be filed by optical media. Optical media filing

corporation at the top of Form 51.

can be used only for Section I information.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2