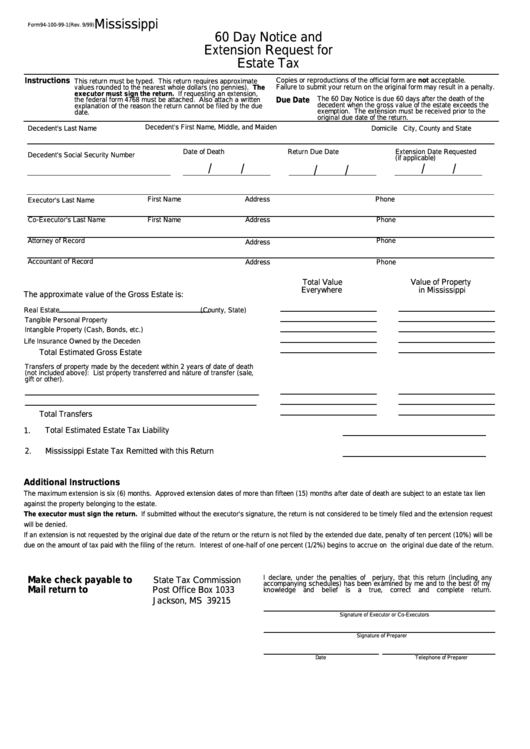

Form 94-100-99-1 - Mississippi 60 Day Notice And Extension Request For Estate Tax

ADVERTISEMENT

Mississippi

Form 94-100-99-1(Rev. 9/99)

60 Day Notice and

Extension Request for

Estate Tax

Instructions

Copies or reproductions of the official form are not acceptable.

This return must be typed. This return requires approximate

Failure to submit your return on the original form may result in a penalty.

values rounded to the nearest whole dollars (no pennies). The

executor must sign the return. If requesting an extension,

Due Date

The 60 Day Notice is due 60 days after the death of the

the federal form 4768 must be attached. Also attach a written

decedent when the gross value of the estate exceeds the

explanation of the reason the return cannot be filed by the due

exemption. The extension must be received prior to the

date.

original due date of the return.

Decedent's First Name, Middle, and Maiden

Decedent's Last Name

Domicile City, County and State

Date of Death

Return Due Date

Extension Date Requested

Decedent's Social Security Number

(if applicable)

/

/

/

/

/

/

First Name

Address

Phone

Executor's Last Name

Co-Executor's Last Name

First Name

Address

Phone

Phone

Attorney of Record

Address

Accountant of Record

Address

Phone

Total Value

Value of Property

Everywhere

in Mississippi

The approximate value of the Gross Estate is:

Real Estate

(County, State)

Tangible Personal Property...............................................................................

Intangible Property (Cash, Bonds, etc.)..............................................................

Life Insurance Owned by the Decedent..............................................................

................................................................

Total Estimated Gross Estate

Transfers of property made by the decedent within 2 years of date of death

(not included above): List property transferred and nature of transfer (sale,

gift or other).

Total Transfers .......................................................................................

1.

Total Estimated Estate Tax Liability

2.

Mississippi Estate Tax Remitted with this Return

Additional Instructions

The maximum extension is six (6) months. Approved extension dates of more than fifteen (15) months after date of death are subject to an estate tax lien

against the property belonging to the estate.

The executor must sign the return. If submitted without the executor's signature, the return is not considered to be timely filed and the extension request

will be denied.

If an extension is not requested by the original due date of the return or the return is not filed by the extended due date, penalty of ten percent (10%) will be

due on the amount of tax paid with the filing of the return. Interest of one-half of one percent (1/2%) begins to accrue on the original due date of the return.

I declare, under the penalties of perjury, that this return (including any

Make check payable to

State Tax Commission

accompanying schedules) has been examined by me and to the best of my

Mail return to

Post Office Box 1033

knowledge

and

belief

is

a

true,

correct

and

complete

return.

Jackson, MS 39215

Signature of Executor or Co-Executors

Signature of Preparer

Date

Telephone of Preparer

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1