Form 74-100-99-1 - Petroleum Tax Registration Application - 1999

ADVERTISEMENT

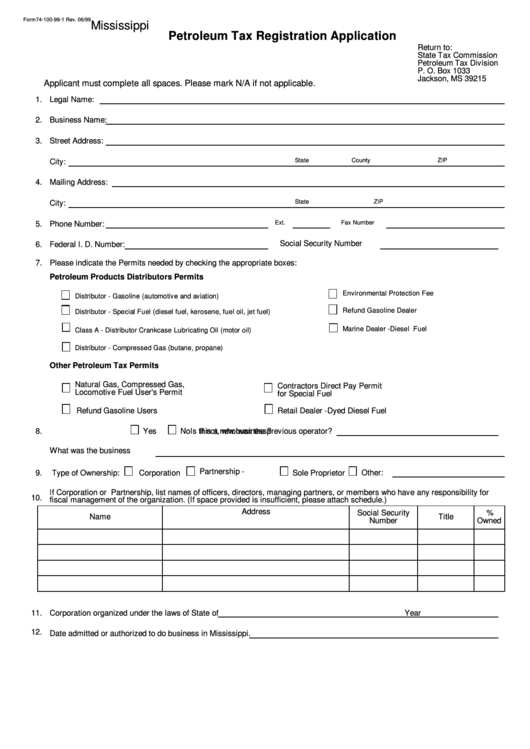

Form 74-100-99-1 Rev. 06/99

Mississippi

Petroleum Tax Registration Application

Return to:

State Tax Commission

Petroleum Tax Division

P. O. Box 1033

Jackson, MS 39215

Applicant must complete all spaces. Please mark N/A if not applicable.

1.

Legal Name:

2.

Business Name:

3.

Street Address:

City:

State

County

ZIP

4.

Mailing Address:

City:

State

ZIP

Ext.

Fax Number

5.

Phone Number:

Social Security Number

6.

Federal I. D. Number:

7. Please indicate the Permits needed by checking the appropriate boxes:

Petroleum Products Distributors Permits

Environmental Protection Fee

Distributor - Gasoline (automotive and aviation)

Refund Gasoline Dealer

Distributor - Special Fuel (diesel fuel, kerosene, fuel oil, jet fuel)

Marine Dealer - Diesel Fuel

Class A - Distributor Crankcase Lubricating Oil (motor oil)

Distributor - Compressed Gas (butane, propane)

Other Petroleum Tax Permits

Natural Gas, Compressed Gas,

Contractors Direct Pay Permit

Locomotive Fuel User's Permit

for Special Fuel

Refund Gasoline Users

Retail Dealer - Dyed Diesel Fuel

8.

Is this a new business?

Yes

No

If not, who was the previous operator?

What was the business

Partnership -

9.

Type of Ownership:

Corporation

Sole Proprietor

Other:

If Corporation or Partnership, list names of officers, directors, managing partners, or members who have any responsibility for

10.

fiscal management of the organization. (If space provided is insufficient, please attach schedule.)

Address

Social Security

%

Name

Title

Number

Owned

11.

Corporation organized under the laws of State of

Year

12.

Date admitted or authorized to do business in Mississippi.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2