BOE-506-PO (S3F) REV. 3 (3-11)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

INSTRUCTIONS

TERMINAL OPERATOR INFORMATION REPORT

General Information

The Terminal Operator Information Report allows terminal operators to report receipts and disbursements of liquid products

to and from each approved terminal.

If you are interested in filing your Terminal Operator Information Report electronically with the BOE, please contact Special

Taxes and Fees at the number listed at the bottom of page (S3B).

To obtain the latest information on any product codes or if you need help completing this form, please visit the BOE's website

at:

Filing Requirements

You must file a report with the BOE and report every gallon of liquid products you received at a California terminal or

disbursed at a California terminal rack for the reporting period. You must file a separate report for each approved terminal that

has a unique IRS terminal control number (TCN). The report must be filed on or before the last day of the calendar month

following the reporting period to which it relates. You must file a report even if you have no activity for the reporting period.

Preparation of the Schedules

There are three types of supporting schedules included with every Terminal Operator Information Report; an ending inventory

schedule (Schedule 15C - Ending Inventory by Product Code) ; a receipt schedule (Schedule 15A - Terminal Operator

Receipts); and a disbursement schedule (Schedule 15B - Terminal Operator Disbursements by Position Holder). Report only

one product code on each schedule page for the period using the product code table (from Schedule 15C - Ending Inventory

by Product Code). Photocopy additional schedule pages as required to report only one product code per page. For

Schedules 15A and 15B, complete the information in box (d) in the header of the schedule. Boxes (a) Company Name, (b)

Account Number, (c) TCN, and (e) Month/Year are already filled in when you receive monthly paper forms from the BOE.

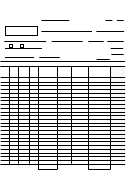

Schedule 15C - Ending Inventory by Product Code

Enter the physical inventory for each product code in net gallons at the end of the reporting period.

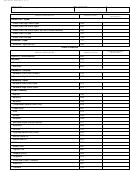

Schedule 15A - Terminal Operator Receipts

Use this schedule to report each receipt of product (bulk and non-bulk) by the terminal operator.

Column 1

Enter the name of the carrier that transported the product into the terminal.

Column 2

Enter the carrier's FEIN (Federal Employer Identification Number).

Column 3

Enter the mode from the mode codes list.

Column 4

Enter the date of the document identified in column 5 (enter as mm/dd/yy).

Column 5

Enter the identifying number from the document provided by the carrier that reflects the details of the

transaction. This could be a bill of lading, shipping document, or manifest. Both the carrier and terminal operator

must report the same document number to the BOE.

Column 6

Enter the net gallons received into the terminal. For non-bulk deliveries to a terminal where net gallons are not

measured, enter gross gallons.

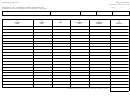

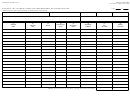

Schedule 15B - Terminal Operator Disbursements by Position Holder

Use this schedule to report each disbursement of product (bulk and non-bulk) from your terminal by position holder.

Note: Two-Party Exchange Transactions

Terminal operators may not participate in two-party exchanges if they are filing paper returns. To participate in a two-party

exchange, all three parties (the delivering supplier, receiving supplier, and terminal operator) must meet certain requirements,

including filing electronic tax forms with us.

Position Holder (PH) Name, Position Holder FEIN

Enter the name and FEIN of the position holder whose product was disbursed at the terminal.

Column 1

Enter the name of the carrier that transported the product out of the terminal.

Column 2

Enter the carrier's FEIN.

Column 3

Enter the mode from the mode codes list.

Column 4

Enter the destination state -- must be a valid, two-character U.S. Postal Service abbreviation (obtain from the

Postal Abbreviations list available on our website). This information is required for non-bulk (truck or rail car)

deliveries only. If a fuel transport truck is receiving fuel destined for different states, the terminal operator will

issue a bill of lading, manifest, or other shipping document on behalf of the position holder for each state of

destination. You are required to report each separate shipping document as a separate transaction. If the

destination is a terminal, enter the TCN.

1

1 2

2 3

3 4

4 5

5 6

6 7

7