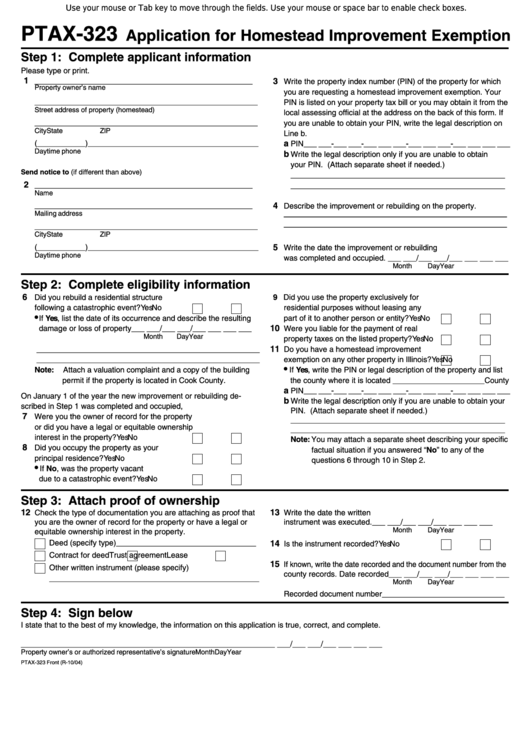

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

PTAX-323

Application for Homestead Improvement Exemption

Step 1: Complete applicant information

Please type or print.

1 ______________________________________________

3

Write the property index number (PIN) of the property for which

Property owner’s name

you are requesting a homestead improvement exemption. Your

___________________________________________________

PIN is listed on your property tax bill or you may obtain it from the

Street address of property (homestead)

local assessing official at the address on the back of this form. If

___________________________________________________

you are unable to obtain your PIN, write the legal description on

City

State

ZIP

Line b.

(___________)_______________________________________

a

PIN___ ___-___ ___-___ ___ ___-___ ___ ___-___ ___ ___ ___

Daytime phone

b

Write the legal description only if you are unable to obtain

your PIN. (Attach separate sheet if needed.)

Send notice to (if different than above)

_________________________________________________

2 ______________________________________________

_________________________________________________

Name

______________________________________________

4

Describe the improvement or rebuilding on the property.

Mailing address

–––––––––––––––––––––––––––––––––––––––––––––––––––

___________________________________________________

–––––––––––––––––––––––––––––––––––––––––––––––––––

City

State

ZIP

(___________)_______________________________________

5

Write the date the improvement or rebuilding

Daytime phone

was completed and occupied. ___ ___/___ ___/___ ___ ___ ___

Month

Day

Year

Step 2: Complete eligibility information

6

Did you rebuild a residential structure

9 Did you use the property exclusively for

following a catastrophic event?

Yes

No

residential purposes without leasing any

•

If Yes, list the date of its occurrence and describe the resulting

part of it to another person or entity?

Yes

No

10

damage or loss of property ___ ___/___ ___/___ ___ ___ ___

Were you liable for the payment of real

Month

Day

Year

property taxes on the listed property?

Yes

No

11

___________________________________________________

Do you have a homestead improvement

___________________________________________________

exemption on any other property in Illinois?

Yes

No

•

Note:

Attach a valuation complaint and a copy of the building

If Yes, write the PIN or legal description of the property and list

permit if the property is located in Cook County.

the county where it is located _____________________County

a

PIN___ ___-___ ___-___ ___ ___-___ ___ ___-___ ___ ___ ___

On January 1 of the year the new improvement or rebuilding de-

b

Write the legal description only if you are unable to obtain your

scribed in Step 1 was completed and occupied,

PIN. (Attach separate sheet if needed.)

7

Were you the owner of record for the property

_________________________________________________

or did you have a legal or equitable ownership

_________________________________________________

interest in the property?

Yes

No

Note: You may attach a separate sheet describing your specific

8

Did you occupy the property as your

factual situation if you answered “No” to any of the

principal residence?

Yes

No

questions 6 through 10 in Step 2.

•

If No, was the property vacant

due to a catastrophic event?

Yes

No

Step 3: Attach proof of ownership

12

13

Check the type of documentation you are attaching as proof that

Write the date the written

you are the owner of record for the property or have a legal or

instrument was executed.

___ ___/___ ___/___ ___ ___ ___

Month

Day

Year

equitable ownership interest in the property.

Deed (specify type)________________________________

14

Is the instrument recorded?

Yes

No

Contract for deed

Trust agreement

Lease

15

If known, write the date recorded and the document number from the

Other written instrument (please specify)

county records. Date recorded___ ___/___ ___/___ ___ ___ ___

________________________________________________

Month

Day

Year

Recorded document number ____________________________

Step 4: Sign below

I state that to the best of my knowledge, the information on this application is true, correct, and complete.

_______________________________________________________

___ ___/___ ___/___ ___ ___ ___

Property owner’s or authorized representative’s signature

Month

Day

Year

PTAX-323 Front (R-10/04)

1

1 2

2