8909

OMB No. 1545-2055

Energy Efficient Appliance Credit

Form

2006

Attach to your tax return.

Attachment

Department of the Treasury

159

Sequence No.

Internal Revenue Service

Name(s) shown on return

Identifying number

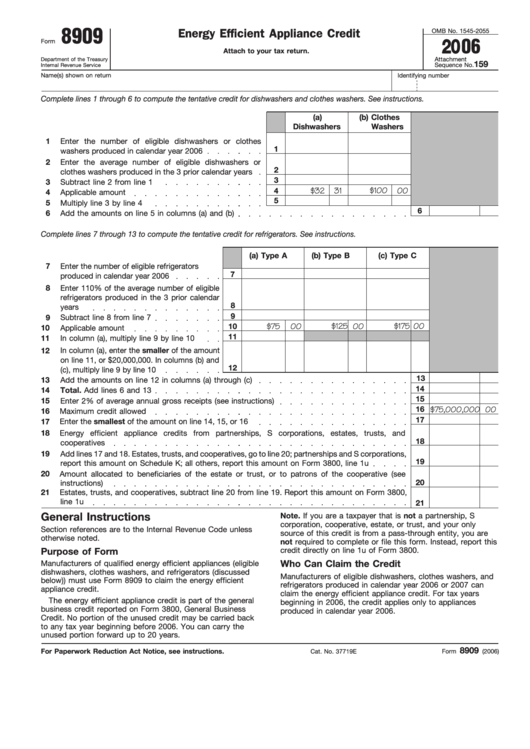

Complete lines 1 through 6 to compute the tentative credit for dishwashers and clothes washers. See instructions.

(a)

(b) Clothes

Dishwashers

Washers

1

Enter the number of eligible dishwashers or clothes

1

washers produced in calendar year 2006

2

Enter the average number of eligible dishwashers or

2

clothes washers produced in the 3 prior calendar years

3

3

Subtract line 2 from line 1

$32

31

$100

00

4

4

Applicable amount

5

5

Multiply line 3 by line 4

6

6

Add the amounts on line 5 in columns (a) and (b)

Complete lines 7 through 13 to compute the tentative credit for refrigerators. See instructions.

(a) Type A

(b) Type B

(c) Type C

7

Enter the number of eligible refrigerators

7

produced in calendar year 2006

8

Enter 110% of the average number of eligible

refrigerators produced in the 3 prior calendar

8

years

9

Subtract line 8 from line 7

9

10

$75

00

$125

00

$175

00

10

Applicable amount

11

11

In column (a), multiply line 9 by line 10

12

In column (a), enter the smaller of the amount

on line 11, or $20,000,000. In columns (b) and

12

(c), multiply line 9 by line 10

13

13

Add the amounts on line 12 in columns (a) through (c)

14

14

Total. Add lines 6 and 13

15

15

Enter 2% of average annual gross receipts (see instructions)

16

$75,000,000

00

16

Maximum credit allowed

17

17

Enter the smallest of the amount on line 14, 15, or 16

18

Energy efficient appliance credits from partnerships, S corporations, estates, trusts, and

18

cooperatives

19

Add lines 17 and 18. Estates, trusts, and cooperatives, go to line 20; partnerships and S corporations,

19

report this amount on Schedule K; all others, report this amount on Form 3800, line 1u

20

Amount allocated to beneficiaries of the estate or trust, or to patrons of the cooperative (see

20

instructions)

21

Estates, trusts, and cooperatives, subtract line 20 from line 19. Report this amount on Form 3800,

line 1u

21

General Instructions

Note. If you are a taxpayer that is not a partnership, S

corporation, cooperative, estate, or trust, and your only

Section references are to the Internal Revenue Code unless

source of this credit is from a pass-through entity, you are

otherwise noted.

not required to complete or file this form. Instead, report this

credit directly on line 1u of Form 3800.

Purpose of Form

Who Can Claim the Credit

Manufacturers of qualified energy efficient appliances (eligible

dishwashers, clothes washers, and refrigerators (discussed

Manufacturers of eligible dishwashers, clothes washers, and

below)) must use Form 8909 to claim the energy efficient

refrigerators produced in calendar year 2006 or 2007 can

appliance credit.

claim the energy efficient appliance credit. For tax years

The energy efficient appliance credit is part of the general

beginning in 2006, the credit applies only to appliances

business credit reported on Form 3800, General Business

produced in calendar year 2006.

Credit. No portion of the unused credit may be carried back

to any tax year beginning before 2006. You can carry the

unused portion forward up to 20 years.

8909

For Paperwork Reduction Act Notice, see instructions.

Cat. No. 37719E

Form

(2006)

1

1