Form St-P-19ae - Sales, Fuel & Special Tax Division Watercraft And/or Materials Incorporated In Watercraft When Sold To A Resident Of Another State

ADVERTISEMENT

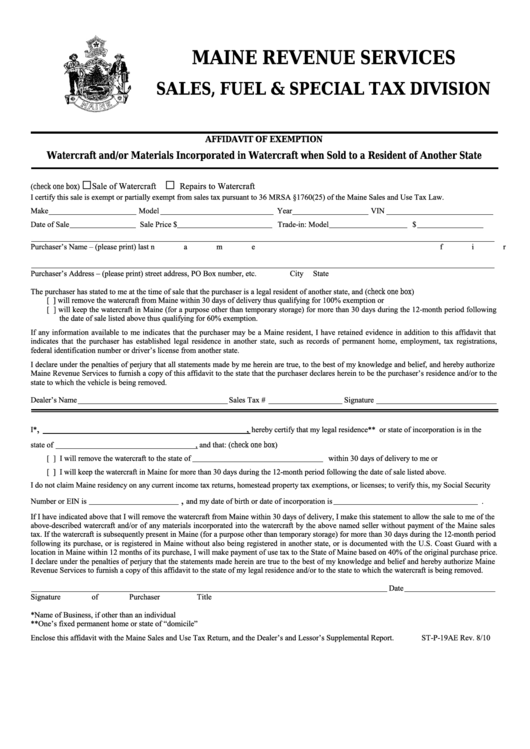

MAINE REVENUE SERVICES

SALES, FUEL & SPECIAL TAX DIVISION

AFFIDAVIT OF EXEMPTION

Watercraft and/or Materials Incorporated in Watercraft when Sold to a Resident of Another State

□

□

Sale of Watercraft

Repairs to Watercraft

(check one box)

I certify this sale is exempt or partially exempt from sales tax pursuant to 36 MRSA §1760(25) of the Maine Sales and Use Tax Law.

Make

Model

Year

VIN

Date of Sale

Sale Price $

Trade-in: Model

$

Purchaser’s Name – (please print) last name

first

middle

Purchaser’s Address – (please print) street address, PO Box number, etc.

City

State

The purchaser has stated to me at the time of sale that the purchaser is a legal resident of another state, and (check one box)

[ ] will remove the watercraft from Maine within 30 days of delivery thus qualifying for 100% exemption or

[ ] will keep the watercraft in Maine (for a purpose other than temporary storage) for more than 30 days during the 12-month period following

the date of sale listed above thus qualifying for 60% exemption.

If any information available to me indicates that the purchaser may be a Maine resident, I have retained evidence in addition to this affidavit that

indicates that the purchaser has established legal residence in another state, such as records of permanent home, employment, tax registrations,

federal identification number or driver’s license from another state.

I declare under the penalties of perjury that all statements made by me herein are true, to the best of my knowledge and belief, and hereby authorize

Maine Revenue Services to furnish a copy of this affidavit to the state that the purchaser declares herein to be the purchaser’s residence and/or to the

state to which the vehicle is being removed.

Dealer’s Name

Sales Tax #

Signature

,

,

I*

hereby certify that my legal residence** or state of incorporation is in the

state of

, and that: (check one box)

[ ] I will remove the watercraft to the state of

within 30 days of delivery to me or

[ ] I will keep the watercraft in Maine for more than 30 days during the 12-month period following the date of sale listed above.

I do not claim Maine residency on any current income tax returns, homestead property tax exemptions, or licenses; to verify this, my Social Security

,

Number or EIN is

and my date of birth or date of incorporation is

.

If I have indicated above that I will remove the watercraft from Maine within 30 days of delivery, I make this statement to allow the sale to me of the

above-described watercraft and/or of any materials incorporated into the watercraft by the above named seller without payment of the Maine sales

tax. If the watercraft is subsequently present in Maine (for a purpose other than temporary storage) for more than 30 days during the 12-month period

following its purchase, or is registered in Maine without also being registered in another state, or is documented with the U.S. Coast Guard with a

location in Maine within 12 months of its purchase, I will make payment of use tax to the State of Maine based on 40% of the original purchase price.

I declare under the penalties of perjury that the statements made herein are true to the best of my knowledge and belief and hereby authorize Maine

Revenue Services to furnish a copy of this affidavit to the state of my legal residence and/or to the state to which the watercraft is being removed.

Date

Signature of Purchaser

Title

*Name of Business, if other than an individual

**One’s fixed permanent home or state of “domicile”

Enclose this affidavit with the Maine Sales and Use Tax Return, and the Dealer’s and Lessor’s Supplemental Report.

ST-P-19AE Rev. 8/10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1