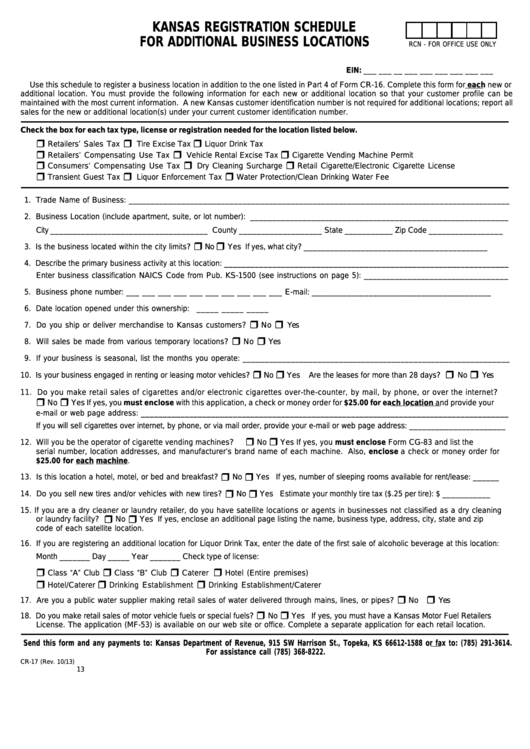

KANSAS REGISTRATION SCHEDULE

FOR ADDITIONAL BUSINESS LOCATIONS

RCN - FOR OFFICE USE ONLY

EIN: ___ ___ __ ___ ___ ___ ___ ___ ___

Use this schedule to register a business location in addition to the one listed in Part 4 of Form CR-16. Complete this form for each new or

additional location. You must provide the following information for each new or additional location so that your customer profile can be

maintained with the most current information. A new Kansas customer identification number is not required for additional locations; report all

sales for the new or additional location(s) under your current customer identification number.

Check the box for each tax type, license or registration needed for the location listed below.

ˆ

ˆ

ˆ

Retailers’ Sales Tax

Tire Excise Tax

Liquor Drink Tax

ˆ

ˆ

ˆ

Retailers’ Compensating Use Tax

Vehicle Rental Excise Tax

Cigarette Vending Machine Permit

ˆ

ˆ

ˆ

Consumers’ Compensating Use Tax

Dry Cleaning Surcharge

Retail Cigarette/Electronic Cigarette License

ˆ

ˆ

ˆ

Transient Guest Tax

Liquor Enforcement Tax

Water Protection/Clean Drinking Water Fee

1. Trade Name of Business: _______________________________________________________________________________________

2. Business Location (include apartment, suite, or lot number): ___________________________________________________________

City ____________________________________ County ___________________ State ___________ Zip Code _________________

ˆ

ˆ

3. Is the business located within the city limits?

No

Yes If yes, what city? __________________________________________

4. Describe the primary business activity at this location: _________________________________________________________________

Enter business classification NAICS Code from Pub. KS-1500 (see instructions on page 5): _________________________________

5. Business phone number: ___ ___ ___ ___ ___ ___ ___ ___ ___ ___

E-mail: _________________________________________

6. Date location opened under this ownership: _____ _____ _____

ˆ

ˆ

7. Do you ship or deliver merchandise to Kansas customers?

No

Yes

ˆ

ˆ

8. Will sales be made from various temporary locations?

No

Yes

9. If your business is seasonal, list the months you operate: _____________________________________________________________

ˆ

ˆ

ˆ

ˆ

10. Is your business engaged in renting or leasing motor vehicles?

No

Yes

Are the leases for more than 28 days?

No

Yes

11. Do you make retail sales of cigarettes and/or electronic cigarettes over-the-counter, by mail, by phone, or over the internet?

ˆ

ˆ

No

Yes If yes, you must enclose with this application, a check or money order for $25.00 for each location and provide your

e-mail or web page address: ____________________________________________________________________________________

If you will sell cigarettes over internet, by phone, or via mail order, provide your e-mail or web page address: ______________________

ˆ

ˆ

12. Will you be the operator of cigarette vending machines?

No

Yes

If yes, you must enclose Form CG-83 and list the

serial number, location addresses, and manufacturer’s brand name of each machine. Also, enclose a check or money order for

$25.00 for each machine.

ˆ

ˆ

13. Is this location a hotel, motel, or bed and breakfast?

No

Yes If yes, number of sleeping rooms available for rent/lease: ______

ˆ

ˆ

14. Do you sell new tires and/or vehicles with new tires?

No

Yes Estimate your monthly tire tax ($.25 per tire): $ ___________

15. If you are a dry cleaner or laundry retailer, do you have satellite locations or agents in businesses not classified as a dry cleaning

ˆ

ˆ

or laundry facility?

No

Yes

If yes, enclose an additional page listing the name, business type, address, city, state and zip

code of each satellite location.

16. If you are registering an additional location for Liquor Drink Tax, enter the date of the first sale of alcoholic beverage at this location:

Month _______ Day _____ Year _______

Check type of license:

ˆ

ˆ

ˆ

ˆ

Class “A” Club

Class “B” Club

Caterer

Hotel (Entire premises)

ˆ

ˆ

ˆ

Hotel/Caterer

Drinking Establishment

Drinking Establishment/Caterer

ˆ

ˆ

17. Are you a public water supplier making retail sales of water delivered through mains, lines, or pipes?

No

Yes

ˆ

ˆ

18. Do you make retail sales of motor vehicle fuels or special fuels?

No

Yes If yes, you must have a Kansas Motor Fuel Retailers

License. The application (MF-53) is available on our web site or office. Complete a separate application for each retail location.

Send this form and any payments to: Kansas Department of Revenue, 915 SW Harrison St., Topeka, KS 66612-1588 or fax to: (785) 291-3614.

For assistance call (785) 368-8222.

CR-17 (Rev. 10/13)

13

1

1