Form Cr-18 - Kansas Business Tax Application Ownership And Signature Form

ADVERTISEMENT

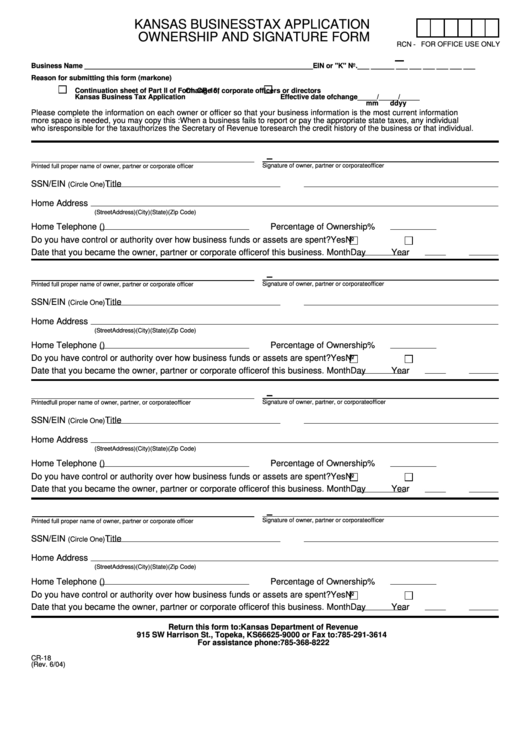

KANSAS BUSINESS TAX APPLICATION

OWNERSHIP AND SIGNATURE FORM

FOR OFFICE USE ONLY

RCN -

Business Name ___________________________________________________________

EIN or "K" No. ___ ___

___ ___ ___ ___ ___ ___ ___

Reason for submitting this form (mark one)

Continuation sheet of Part II of Form CR-16,

Change of corporate officers or directors

Kansas Business Tax Application

Effective date of change _____/_____/_____

mm

dd

yy

Please complete the information on each owner or officer so that your business information is the most current information possible. If

more space is needed, you may copy this form. Note: When a business fails to report or pay the appropriate state taxes, any individual

who is responsible for the tax authorizes the Secretary of Revenue to research the credit history of the business or that individual.

-

Signature of owner, partner or corporate officer

Printed full proper name of owner, partner or corporate officer

SSN/EIN

Title

(Circle One)

Home Address

(Street Address)

(City)

(State)

(Zip Code)

Home Telephone (

)

Percentage of Ownership

%

Do you have control or authority over how business funds or assets are spent?

Yes

No

Date that you became the owner, partner or corporate officer of this business. Month

Day

Year

-

Signature of owner, partner or corporate officer

Printed full proper name of owner, partner or corporate officer

SSN/EIN

Title

(Circle One)

Home Address

(Street Address)

(City)

(State)

(Zip Code)

Home Telephone (

)

Percentage of Ownership

%

Do you have control or authority over how business funds or assets are spent?

Yes

No

Date that you became the owner, partner or corporate officer of this business. Month

Day

Year

-

-

Signature of owner, partner, or corporate officer

Printed full proper name of owner, partner, or corporate officer

SSN/EIN

Title

(Circle One)

Home Address

(Street Address)

(City)

(State)

(Zip Code)

Home Telephone (

)

Percentage of Ownership

%

Do you have control or authority over how business funds or assets are spent?

Yes

No

Date that you became the owner, partner or corporate officer of this business. Month

Day

Year

-

Signature of owner, partner or corporate officer

Printed full proper name of owner, partner or corporate officer

SSN/EIN

Title

(Circle One)

Home Address

(Street Address)

(City)

(State)

(Zip Code)

Home Telephone (

)

Percentage of Ownership

%

Do you have control or authority over how business funds or assets are spent?

Yes

No

Date that you became the owner, partner or corporate officer of this business. Month

Day

Year

Return this form to: Kansas Department of Revenue

915 SW Harrison St., Topeka, KS 66625-9000 or Fax to: 785-291-3614

For assistance phone: 785-368-8222

CR-18

(Rev. 6/04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1