Form Non-Corp - Non-Corporate Business Profits Tax Reconciliation Of New Hampshire Gross Business Profits

ADVERTISEMENT

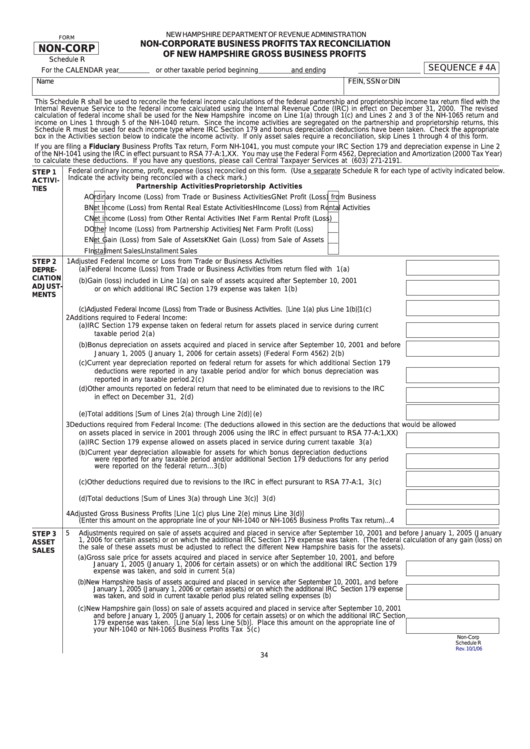

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

NON-CORPORATE BUSINESS PROFITS TAX RECONCILIATION

NON-CORP

OF NEW HAMPSHIRE GROSS BUSINESS PROFITS

Schedule R

SEQUENCE # 4A

For the CALENDAR year

or other taxable period beginning

and ending

Name

FEIN, SSN or DIN

This Schedule R shall be used to reconcile the federal income calculations of the federal partnership and proprietorship income tax return filed with the

Internal Revenue Service to the federal income calculated using the Internal Revenue Code (IRC) in effect on December 31, 2000. The revised

calculation of federal income shall be used for the New Hampshire income on Line 1(a) through 1(c) and Lines 2 and 3 of the NH-1065 return and

income on Lines 1 through 5 of the NH-1040 return. Since the income activities are segregated on the partnership and proprietorship returns, this

Schedule R must be used for each income type where IRC Section 179 and bonus depreciation deductions have been taken. Check the appropriate

box in the Activities section below to indicate the income activity. If only asset sales require a reconciliation, skip Lines 1 through 4 of this form.

If you are filing a Fiduciary Business Profits Tax return, Form NH-1041, you must compute your IRC Section 179 and depreciation expense in Line 2

of the NH-1041 using the IRC in effect pursuant to RSA 77-A:1,XX. You may use the Federal Form 4562, Depreciation and Amortization (2000 Tax Year)

to calculate these deductions. If you have any questions, please call Central Taxpayer Services at (603) 271-2191.

Federal ordinary income, profit, expense (loss) reconciled on this form. (Use a separate Schedule R for each type of activity indicated below.

STEP 1

Indicate the activity being reconciled with a check mark.)

ACTIVI-

Partnership Activities

Proprietorship Activities

TIES

A

Ordinary Income (Loss) from Trade or Business Activities

G

Net Profit (Loss) from Business

B

Net Income (Loss) from Rental Real Estate Activities

H

Income (Loss) from Rental Activities

C

Net income (Loss) from Other Rental Activities

I

Net Farm Rental Profit (Loss)

D

Other Income (Loss) from Partnership Activities

J

Net Farm Profit (Loss)

E

Net Gain (Loss) from Sale of Assets

K

Net Gain (Loss) from Sale of Assets

F

Installment Sales

L

Installment Sales

1

Adjusted Federal Income or Loss from Trade or Business Activities

STEP 2

(a) Federal Income (Loss) from Trade or Business Activities from return filed with IRS ................... 1(a)

DEPRE-

CIATION

(b) Gain (loss) included in Line 1(a) on sale of assets acquired after September 10, 2001

ADJUST-

or on which additional IRC Section 179 expense was taken ......................................................... 1(b)

MENTS

(c) Adjusted Federal Income (Loss) from Trade or Business Activities. [Line 1(a) plus Line 1(b)] ............ 1(c)

2

Additions required to Federal Income:

(a) IRC Section 179 expense taken on federal return for assets placed in service during current

taxable period .................................................................................................................................. 2(a)

(b) Bonus depreciation on assets acquired and placed in service after September 10, 2001 and before

January 1, 2005 (January 1, 2006 for certain assets) (Federal Form 4562) ................................ 2(b)

(c) Current year depreciation reported on federal return for assets for which additional Section 179

deductions were reported in any taxable period and/or for which bonus depreciation was

reported in any taxable period. ........................................................................................................ 2(c)

(d) Other amounts reported on federal return that need to be eliminated due to revisions to the IRC

in effect on December 31, 2000 ...................................................................................................... 2(d)

(e) Total additions [Sum of Lines 2(a) through Line 2(d)] ..................................................................... 2(e)

3

Deductions required from Federal Income: (The deductions allowed in this section are the deductions that would be allowed

on assets placed in service in 2001 through 2006 using the IRC in effect pursuant to RSA 77-A:1,XX)

(a) IRC Section 179 expense allowed on assets placed in service during current taxable period .... 3(a)

(b) Current year depreciation allowable for assets for which bonus depreciation deductions

were reported for any taxable period and/or additional Section 179 deductions for any period

were reported on the federal return ............................................................................................... 3(b)

(c) Other deductions required due to revisions to the IRC in effect pursurant to RSA 77-A:1, XX. ... 3(c)

(d) Total deductions [Sum of Lines 3(a) through Line 3(c)] ................................................................. 3(d)

4

Adjusted Gross Business Profits [Line 1(c) plus Line 2(e) minus Line 3(d)]

(Enter this amount on the appropriate line of your NH-1040 or NH-1065 Business Profits Tax return) ... 4

5

Adjustments required on sale of assets acquired and placed in service after September 10, 2001 and before January 1, 2005 (January

STEP 3

1, 2006 for certain assets) or on which the additional IRC Section 179 expense was taken. (The federal calculation of any gain (loss) on

ASSET

the sale of these assets must be adjusted to reflect the different New Hampshire basis for the assets).

SALES

(a) Gross sale price for assets acquired and placed in service after September 10, 2001, and before

January 1, 2005 (January 1, 2006 for certain assets) or on which the additional IRC Section 179

expense was taken, and sold in current period ............................................................................. 5(a)

(b) New Hampshire basis of assets acquired and placed in service after September 10, 2001, and before

January 1, 2005 (January 1, 2006 or certain assets) or on which the additional IRC Section 179 expense

was taken, and sold in current taxable period plus related selling expenses .................................... 5(b)

(c) New Hampshire gain (loss) on sale of assets acquired and placed in service after September 10, 2001

and before January 1, 2005 (January 1, 2006 for certain assets) or on which the additional IRC Section

179 expense was taken. [Line 5(a) less Line 5(b)]. Place this amount on the appropriate line of

your NH-1040 or NH-1065 Business Profits Tax Return ................................................................ 5(c)

Non-Corp

Schedule R

Rev. 10/1/06

34

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1