Page 2 of 2 RP-425-Rnw (10/15)

Instructions

General information

Application instructions

The New York State School Tax Relief (STAR) Program

Print the name and mailing address of each person who both

provides an exemption from school taxes for owner-occupied,

owns and primarily resides in the property. (If the title to the

property is in a trust, the trust beneficiaries are deemed to be

primary residences where the combined 2014 income of the

owners and spouses who reside on the property does not

the owners for STAR purposes.) There is no single factor which

exceed $500,000. Senior citizens with combined 2014 incomes

determines whether the property is your primary residence, but

that do not exceed $84,550 may qualify for a larger Enhanced

factors such as utility bills, voting and automobile registrations,

exemption.

and the length of time you occupy the property each year may

be relevant. The assessor may ask you to provide proof of

Note: Senior citizens who wish to continue receiving Enhanced

residency and ownership. For the enhanced exemption, proof of

STAR in future years without having to reapply and submit

age may also be required. The parcel identification number may

copies of their tax returns to their assessor every year are

be obtained from either the assessment roll or your tax bill.

invited to sign up for the STAR Income Verification Program.

See Form RP-425-IVP, School Tax Relief (STAR) Exemption,

Income for STAR purposes: Use the following table for

Optional Income Verification Program, for more information.

identifying line references on 2014 federal and state income tax

forms. You may not use your 2015 tax forms.

Seniors who do not choose to enroll in the income verification

program must reapply each year to keep the Enhanced

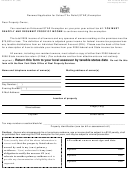

Form

Title of income

Income for STAR

exemption in effect. If you are receiving the Basic exemption,

number

tax form

purposes

you usually do not need to reapply in subsequent years, but you

must notify the assessor if your primary residence changes and

IRS

U.S. Individual

Line 37 minus line 15b

must provide income documentation when requested.

Form 1040

Income Tax

adjusted gross income minus

Return

Deadline: The application must be filed with your local

taxable amount (of total IRA

distributions)

assessor on or before the applicable taxable status date, which

is generally March 1; in Westchester towns it is either May 1

IRS

U.S. Individual

Line 21 minus line 11b

or June 1 - contact local assessor; in Nassau County it is

Form 1040A

Income Tax

adjusted gross income minus

January 2, and; in cities, check with your assessor. For further

Return

taxable amount (of total IRA

information, ask your local assessor.

distributions)

IRS

Income Tax

Line 4 only

Form 1040EZ

Return for

adjusted gross income

Single and Joint

(No adjustment needed for

Filers With No

IRAs.)

Dependents

NYS

Resident

Line 19 minus line 9

Form IT-201

Income Tax

federal adjusted gross income

Return

minus taxable amount of IRA

distributions

This Area for Assessor’s Use Only

No

Application received:

Approved:

Yes

Senior additional:

Yes

No

Proof of age:

Form RP-425-IVP received:

Yes

No

Proof of income:

Proof of residency:

Assessor’s name

Assessor’s signature

Date

1

1 2

2