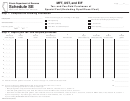

Schedule PDA-49Q Instructions

Purpose

Line 3 Instructions

The tax imposed on undyed diesel fuel de-

A surcharge is imposed on all motor fuels

livered to a qualified service station may be

effective Aug. 1, 2008, and is updated an-

reduced to a rate of $0.03 per gallon above

nually.

the contiguous state tax rate imposed on

To determine the tax rate reduction to enter

like products.

on line 3, use the following formula:

To qualify, a service station operating in

1 Minnesota tax rate and sur-

Minnesota must be in competition with a

charge for the period (see

service station located in a contiguous state

table below) . . . . . . . . . . . . . . . . .

within 7.5 miles (measured by the short-

est route by public road) of the Minnesota

2 Other state’s tax rate . . . . . . . . . .

service station.

3 Subtract step 2 from step 1 . . . .

In addition, when computing the special

4 Rate for qualifying service

fuel excise tax due, a deduction of 1 percent

.03

station . . . . . . . . . . . . . . . . . . . . .

per gallon is allowed for evaporation and

loss.

5 Subtract step 4 from step 3.

Also enter the result on line 3 . $

Complete Schedule PDA-49Q to determine

the qualifying service station adjustment to

Use the table below to determine the Min-

report on Form PDA-49, Special Fuel Tax

nesota tax rate and surcharge to enter on

Return.

step 1:

the tax

If the period is:

rate is:

prior to April 1, 2008 . . . . . . . . . . . . . . 0.20

April 1 through July 31, 2008 . . . . . . . 0.22

Aug. 1 through Sept. 30, 2008 . . . . . . . 0.225

Oct. 1, 2008 through June 30, 2009 . . 0.255

July 1, 2009 through June 30, 2010 . . 0.271

July 1, 2010 through June 30, 2011 . . 0.275

July 1, 2011 through June 30, 2012 . . 0.28

July 1, 2012 through current . . . . . . . . 0.285

1

1 2

2