Form Pda-49 - Special Fuel Tax Return - 2002

ADVERTISEMENT

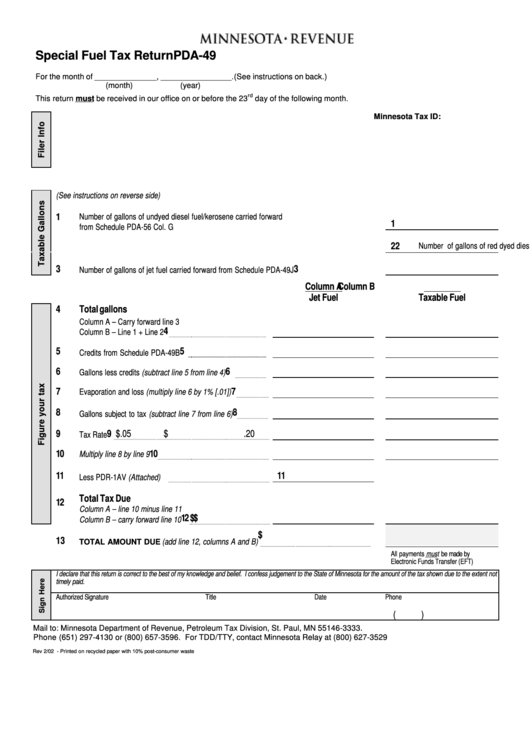

Special Fuel Tax Return

PDA-49

For the month of ______________, ________________. (See instructions on back.)

(month)

(year)

rd

This return must be received in our office on or before the 23

day of the following month.

Minnesota Tax ID:

(See instructions on reverse side)

1

Number of gallons of undyed diesel fuel/kerosene carried forward

1

from Schedule PDA-56 Col. G

2

2

Number of gallons of red dyed diesel fuel/kerosene carried forward from Schedule PDA-49G

3

3

Number of gallons of jet fuel carried forward from Schedule PDA-49J

Column A

Column B

Jet Fuel

Taxable Fuel

4

Total gallons

Column A – Carry forward line 3

4

Column B – Line 1 + Line 2

5

5

Credits from Schedule PDA-49B

6

6

Gallons less credits (subtract line 5 from line 4)

7

7

Evaporation and loss (multiply line 6 by 1% [.01])

8

8

Gallons subject to tax (subtract line 7 from line 6)

9

9 $

.05

$

.20

Tax Rate

10

10

Multiply line 8 by line 9

11

11

Less PDR-1AV (Attached)

Total Tax Due

12

Column A – line 10 minus line 11

12 $

$

Column B – carry forward line 10

$

13

(add line 12, columns A and B)

TOTAL AMOUNT DUE

All payments must be made by

Electronic Funds Transfer (EFT)

I declare that this return is correct to the best of my knowledge and belief. I confess judgement to the State of Minnesota for the amount of the tax shown due to the extent not

timely paid.

Authorized Signature

Title

Date

Phone

(

)

Mail to: Minnesota Department of Revenue, Petroleum Tax Division, St. Paul, MN 55146-3333.

Phone (651) 297-4130 or (800) 657-3596. For TDD/TTY, contact Minnesota Relay at (800) 627-3529

Rev 2/02 - Printed on recycled paper with 10% post-consumer waste

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1