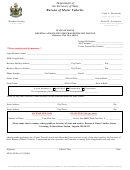

Form Dr 0594 - Renewal Application For Sales Tax License Page 2

ADVERTISEMENT

INSTRUCTIONS

1. If all information on the front of this form is

7. If locations have been deleted, recompute Total

correct as shown, sign on the bottom line, attach

Fee due, cross out fee shown in "TOTAL FEE(S)"

remittance for the amount shown in "TOTAL

and insert proper amount. A $16.00 two-year

FEE(S)"

block,

and

mail

to

the

Colorado

renewal fee is due for each location within the

Department of Revenue.

state of Colorado. Sign on line provided, attach

check for correct amount and mail to Colorado

2. Show any change in name and address on lines

Department of Revenue.

provided if different from the name and address

shown at the top of the front side of this form.

8. PENALTY - Any person, firm, corporation,

co-partneship or association who shall violate

3. If one or more places of business have been

any of the provisions of this act shall be deemed

discontinued, draw a line through the locations

guilty of a misdemeanor, and upon conviction

and note date location was closed. (DO NOT

thereof, shall be fined in any sum not less than

COMPLETELY OBLITERATE DATA SHOWN).

two hundred dollars ($200.00), and each and

every day that such violation continues shall

4. If data shown is incorrect, draw a line through

constitute a separate and distinct offense.

incorrect data and insert correct information

above.

If locations are not shown on Renewal Form,

5.

request application form CR 100.

6. No fee is required for jurisdictions in which you

do not have a business location but are required

to collect a local tax. These businesses are mainly

telephone and utility companies and leasing

companies.

The

street

address

of

these

jurisdictions should be listed as "No Physical

Location" or "Remainder of Ctny."

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2