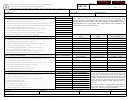

Form CIG 50004 - Page 2

Instructions for Consolidated Monthly Cigarette Return

Including Multi-State and Tribal Rates

1. Complete all requested information regarding your wholesale company.

2. Indicate whether this return is for 20 or 25 packs cigarettes. Use a separate sheet for each size cigarette packages.

3. Indicate in the column headers the tax jurisdiction you are reporting for that column, whether it is a tribal designation or another state. Use an additional page if

there are not enough columns.

4. Fill in all applicable information for each column.

5. Please note that:

Lines 1 + 2 = lines 4 + 5 + 7

_

lines 8 + 9 + 10 + 11 - 12 = lines 13 + 14

Lines 15 + 16 + 17 = lines 19 + 20 + 21 + 23

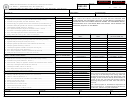

Definitions

“Full Tax Rate” – means all full-tax-rate locations in the State of Oklahoma and retail locations located on trust land owned or licensed by Federally Recognized

Indian Tribes or Nations, which have NOT signed a compact with the State of Oklahoma regarding cigarette and tobacco products.

“State/Tribal Border Compact” – means retail locations located on trust land owned or licensed by Federally Recognized Indian Tribes or Nations, which signed

compacts with the State of Oklahoma regarding cigarette and tobacco products after July1, 2008 and are located within twenty (20) miles of the state line between

Oklahoma and Kansas or Oklahoma and Missouri.

“New Compact” – means retail locations located on trust land owned or licensed by Federally Recognized Indian Tribes or Nations, which signed compacts with

the State of Oklahoma regarding cigarette and tobacco products after January 1, 2003.

“Exception Rate” – means certain retail locations on trust lands in other specific locations, owned or licensed by Federally Recognized Indian Tribes or Nations

which signed compacts with the State of Oklahoma regarding cigarettes and tobacco products after January 1, 2003 and are located within twenty (20) miles of the

state line between Oklahoma and Kansas or Oklahoma and Missouri.

“State/Tribal Compact” – means retail locations located on trust land owned or licensed by Federally Recognized Indian Tribes or Nations, which signed compacts

with the State of Oklahoma regarding cigarette and tobacco products after July1, 2008.

Black Stamp or No Tax Rate –

retail locations located on trust land owned or licensed by Federally Recognized Indian Tribes or Nations, which have NOT signed a

compact with the State of Oklahoma regarding cigarette and tobacco products. This tobacco product can only be sold to that tribe’s tribal member.

1

1 2

2